Electronic money exists relatively recently. But they have already received recognition from Internet users. At the same time, for many, the essence of electronic payments remains not fully understood. What is electronic money in Russia?

General points

Japan first began using electronic money in the 1980s. It began with the introduction of prepaid chip cards from individual companies, which over time began to be used by other economic entities.

For Europe, the first use of prepaid electronic payment products began in the 1990s. Individuals could save their funds on special cards (Mondex, Proton, Danmont and Primeur Card).

Interest in such payment methods was attracted by innovative technologies, as well as the lack of affiliation with the banking industry. After some time, similar projects began to be implemented by banks.

A little later, new payment technologies came to Russia. And if at first they were perceived with some doubt, then by 2013 the turnover of the electronic payment market in the Russian Federation reached almost two and a half trillion rubles.

Several factors contributed to the development of the use of electronic money. In particular, the active spread of online commerce, the low cost of Internet transactions, the possibility of instant execution of transactions without personal identification.

The scale of the spread of electronic means of payment and their considerable importance in settlements between legal and private entities have led to the need to resolve the main issues of application.

The state was required to:

Basic definitions

Electronic money, in essence, is money in the usual sense of the word. They can be used to pay for purchases in online stores, pay for various services, and transfer to bank accounts and cards.

But they have the advantage of mobility. There is no reference to time and place. You can make a payment from anywhere in the world and at any time of the day. The main condition is access to the Internet.

The main formulations are that electronic money is:

The term “electronic money” is far from ambiguous. It is used in a variety of understandings. This definition refers to systems for storing and transferring both official and private currencies.

Consequently, the rules for the circulation of electronic money are regulated both by the provisions of Central Banks and by the personal regulations of payment systems.

In a more simplified sense, electronic money payments can be thought of as a transfer of regular cash from one bank account to another. At the same time, the procedure is quite simple and does not require unnecessary formalities.

Their qualifications

Most often, electronic cash is classified as follows:

In Russia, the following electronic payment products are considered the most popular::

- Yandex money;

- WebMoney;

- Single wallet;

- RBC Money;

- PayCash;

- Rapida.

Most of Russian electronic payment systems are not represented by financial organizations. Their activities are not considered financial.

This allows payment systems to reduce costs arising from banking activities. But at the same time, this prevents the conduct of legally complete financial relations between participants in the system.

It is this state of affairs that requires clear legislative regulation of the concept of electronic money and the rules for its use.

Current standards

Initially, the legality of the circulation of electronic money was questioned, since it does not recognize electronic money as cash. Therefore, payment systems have found a way to solve this problem.

In particular, electronic cash has received a different name. For example, WebMoney title units or PayCash advance payments.

Thus, electronic money becomes not cash, but prepaid cash title units or securities.

At the same time, electronic money has become a way to take into account the rights of claims of users of electronic payment systems to representatives of these systems.

Electronic payments are essentially the exchange of messages that confirm the transfer of title units and property rights.

As for the legal aspect, the payment system is a guarantor that guarantees to third parties the payment of an amount equivalent to a unit of the system through a bank.

From a legal point of view, electronic money is an analogue of checks, securities, and gift certificates. That is, payment systems issue securities using uncertificated bearer checks.

Also worthy of attention. It presupposes the possibility of carrying out legal circulation of securities not provided for by law. This means that the circulation of electronic money does not violate Russian legislation.

At this time, the electronic money market in Russia is regulated by the Central Bank of the Russian Federation. The main governing law is.

Some changes came into force on May 16, 2014. He made adjustments to Federal Law No. 161.

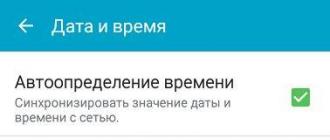

In accordance with the new amendments, mandatory user identification has been introduced for individuals, non-profit organizations and organizations created outside the Russian Federation. At the same time, a simplified identification procedure became possible.

Features of electronic money

The main feature of electronic money is its virtuality. Such means of payment cannot be seen, touched or put in your pocket.

But this does not diminish their value. Of course, you can’t pay with that kind of money in regular stores. However, you can make purchases via the Internet, pay for various payments and services, and transfer funds to other persons.

As for other features, electronic money can be personalized and anonymous. This depends on the rules for handling electronic cash in the system.

At the same time, all sorts of attempts are being made to personalize most electronic means. To achieve this, limits are introduced for anonymous users and the size of the anonymous wallet is limited.

Security cryptographic methods can also be called an important feature of electronic payment instruments. They allow you to achieve a certain security when using electronic cash.

That is, electronic money is reliably protected by an electronic digital signature. This eliminates the possibility of counterfeiting electronic money.

Who are they using?

Basically in Russia, electronic money is used to pay for cellular communications, Internet access, utilities, and Internet purchases.

Often, electronic payments are used to transfer funds to other users of the system. Teenagers often spend money on online games. The older population pays for goods and services, taxes and fines in this way.

In terms of the number of users who have used electronic payments at least once, Russian statistics for a large city are as follows?

At the same time, 14% of the younger generation spends money earned on the Internet. 48% of the older generation are novice users.

Electronic money is increasingly used when conducting online business. At the same time, electronic money is considered as a form of modern market economy.

Electronic payments allow instant settlements between entrepreneurs and clients. This eliminates many of the costs inherent in doing business offline.

Forms of their use

According to the forms of use of electronic means, several main methods can be distinguished.

These include:

| Internet banking | Using this method, you can transfer money from your bank account to any other, including an electronic wallet account. The received electronic money can be used for any possible purpose. At the same time, the transfer can be monitored online. Instead of a signature, the client of a virtual bank uses an electronic digital signature, which is considered the most reliable method of protection |

| Credit cards | The method is convenient because it allows you to pay in any currency, including electronic ones. But it is advisable not to transfer personal data when using this option, since the protection of credit cards is not so perfect |

| ATMs | You can cash out your electronic money through an ATM. To do this, just order a virtual debit card from the payment system and transfer funds from an electronic wallet to it. The cashing process is no different from using a regular plastic card. You need to enter virtual card details and withdraw cash from it |

| Bank checks | This option is acceptable for receiving cash from a bank. You can transfer electronic money to a bank account and then withdraw the money. Or transfer electronic funds to a bank that will exchange them for cash. This method also includes sending electronic money through the system of international transfers with receipt at any bank |

What is their advantage

The most significant advantages of electronic money include:

- the ability to pay anywhere and at any time;

- almost instant transfer of funds;

- convenience and ease of use.

Less obvious advantages include the possibility of reducing queues at cash registers and reducing the burden on accounting. In addition, electronic money is protected from counterfeiting.

They are portable, that is, they will not take up much space in any quantity. They divide perfectly, eliminating the need to wait for change.

Electronic money can be stored as long as you like, without this its appearance becoming unusable. With electronic payments, the human factor is completely eliminated, meaning all payments will reach their intended destination.

Disadvantages of such payments

Among the disadvantages, the following are especially significant:

- the need to pay interest to the system when withdrawing money;

- possibility of wallet hacking;

- loss of money if you lose your password.

With a more detailed analysis of the shortcomings, they are practically reduced to zero. When withdrawing funds, you need to pay a certain percentage for withdrawal. But banks also charge fees for services and transactions.

Therefore, this disadvantage is rather the usual cost of contacting third parties to carry out financial transactions. The e-wallet can be hacked. In this case, a third party will log into the system and spend or transfer the stored funds.

And most often the user himself is to blame for this. You can log in to the system only using a username and password that are created by the owner of the wallet. The possibility of theft of confidential data depends on how carefully he stores his data.

Another drawback is that if you lose your password, you will not be able to log in to the system. This means that no transactions with electronic means will be possible. The basic advice is still the same - keep your password in a safe place.

But you shouldn’t neglect the password recovery method. To do this, when registering in the payment system, you need to identify your identity in as much detail as possible.

Ideally, provide scans of documents, link your email and phone number. After this, even losing your password is not a problem. Using your identification data, you can obtain the right to renew access and change your password.

In general, electronic money is a very flexible tool that allows you to expand the scope of use of cash and significantly simplify cash flow.

In Russia, the use of electronic payment systems is not yet well developed. But given the pace of development, it can be assumed that in the future electronic money will be given a fairly significant priority.

Neighboring countries of the Russian Federation also use various electronic payment systems. Belarus is no exception. An electronic payment system called Easypay has been operating on the territory of this state for quite a long time. It has its own characteristics, connected to the ERIP system, as well as acquiring...

Electronic payment systems are becoming increasingly popular. Active network users have long appreciated the convenience of using virtual currency. How easy is it to withdraw money from an electronic wallet? Recently, electronic payment systems have taken a strong place in the financial sector. Caused this phenomenon...

Thanks to high technologies, it has become possible not only to earn money via the Internet, but also to receive your salary without leaving home. Electronic wallets are software. With its help, the owner of the wallet can hold funds electronically, carry out various operations, including retail payments and...

47.5KElectronic money is the monetary obligations of the organization that issued it (the issuer), located on electronic media under the control of users.

Main features of electronic money:

- carrying out issuance in electronic form;

- storage on electronic media;

- the issuer's guarantees for their provision with ordinary funds;

- their recognition as a means of payment not only by the issuer, but also by a number of other organizations.

To clearly understand what electronic money is, it is necessary to distinguish it from the non-cash form of traditional money (the latter is issued by the central banks of various countries, and they also establish the rules for their circulation).

Credit cards, which are only a means of managing a bank account, have nothing to do with electronic money. All transactions when using cards are carried out with ordinary money, albeit in non-cash form.

The history of electronic money

The idea of electronic payment systems appeared in the 80s of the twentieth century. It was based on the inventions of David Shaum, who founded the DigiCash company in the USA, whose main task was to introduce electronic money circulation technologies.

The idea was quite simple. The system carries out operations with electronic coins, which are files-obligations of the issuer with his electronic signature. The purpose of the signature was similar to the purpose of the security elements of paper bills.

Principles of operation of electronic money systems

For the successful operation of this payment instrument, it is necessary that organizations selling goods and providing services be willing to accept electronic money as payment. This condition was ensured by the issuer’s guarantees for the payment of amounts in real currency in exchange for electronic coins put into circulation by it.

In a simplified form, the system’s functioning diagram can be represented as follows:

- The client transfers real currency to the issuer's account, receiving in return a file banknote (coin) for the same amount minus a commission. This file confirms the issuer's debt obligations to its holder;

- The client uses electronic coins to pay for goods and services in organizations that are ready to accept them;

- The latter return these files to the issuer, receiving real money from him in return.

With this organization of work, each party benefits. The issuer receives his commission. Trading enterprises save on costs associated with cash handling (storage, collection, cashier work). Customers receive discounts due to lower costs from sellers.

Advantages of electronic money:

- Unitability and divisibility. When making payments there is no need for change.

- Compactness. Storage does not require additional space or special mechanical protection devices.

- No need for recounting or transportation. This function is performed automatically by payment and electronic money storage tools.

- Minimum emission costs. There is no need to mint coins or print banknotes.

- Unlimited service life due to resistance to wear.

The advantages are obvious, but, as usual, there are no difficulties.

Flaws:

- The circulation of electronic money is not regulated by uniform laws, which increases the likelihood of abuse and arbitrariness;

- The need for special payment and storage tools;

- For a relatively short period of operation, reliable means of storing and protecting electronic money from counterfeiting have not been developed;

- Limited application due to the unwillingness of all sellers to accept electronic payments;

- The difficulty of converting funds from one electronic payment system to another;

- Lack of government guarantees confirming the reliability of the issuer and electronic money as such.

Storage and use of electronic money

Online wallet– this is software designed for storing electronic funds and carrying out transactions with them within one system.

Who organizes the functioning of these systems and issues electronic money?

Electronic money issuers

Requirements for issuers vary from country to country. In the EU, issues are carried out by electronic money institutions - a new special class of financial institutions. In accordance with the legislation of a number of countries, including India, Mexico, Ukraine, only banks have the right to engage in this activity. In Russia - both banks and non-banking financial organizations, subject to their obtaining a license.

Electronic payment systems in Russia

Let's look at the most popular domestic systems and give answers to questions about how to buy and how to cash out electronic money in each of them.

The largest operators are Yandex.Money and WebMoney, their total share exceeds 80% of the market, but there are also PayPal, Moneybookers, and Qiwi...

"WebMoney"

"WebMoney", positioning itself as an "international payment system", was founded in 1998. Its owner is WM Transfer Ltd. It is registered in London, but technical services and the Main Certification Center are located in Moscow.Transactions are carried out with electronic equivalents of a number of currencies.

For each of them, the guarantor is legal entities registered in various countries: Russia, Ukraine, Switzerland, UAE, Ireland and Belarus.

For work, the electronic wallet “WebMoney Keeper” is used, which can be downloaded from the company’s website. There are also instructions for its installation, registration and use. The program allows you to operate in equivalents of US dollars (WMZ), Russian rubles (WMR), euros (WME), Belarusian rubles (WMB) and Ukrainian hryvnia (WMU). The circulation of gold is provided, the unit of measurement of which is 1 electron gram (WMG).

To carry out operations, you need to register in the system and obtain a participant certificate, of which there are 12 types.

A higher level of certification provides greater opportunities in work.

When making transactions, the payer is charged a commission in the amount of 0.8% of the transfer amount. It is possible to use various types of payment protection. All controversial issues are resolved by Arbitration.

Here are the ways to deposit electronic money into a wallet:

- bank, postal or telegraphic transfer;

- through the Western Union system;

- purchasing a prepaid card;

- by depositing cash at exchange offices;

- through electronic terminals;

- from electronic wallets of other system participants.

All of the above methods involve the payment of commissions. It is least profitable to deposit money through terminals and buy prepaid cards.

How to cash out electronic money in the WebMoney system? You can use the following methods:

- transfer to a bank account from your electronic wallet;

- using the services of an exchange office;

- through the Western Union system.

There are virtual points where it is possible to automatically exchange one electronic currency for another at a specified rate, although the system does not formally take part in this.

Since 2009, the use of WebMoney has been prohibited by law in Germany. This prohibition also applies to individuals.

"Yandex money"

The system has been operating since 2002. It provides settlements between participants in Russian rubles. The owner of the system, Yandex.Money LLC, sold 75% of the shares to Sberbank of Russia in December 2012.Two types of accounts are used:

- "Yandex.Wallet", which is accessible via a web interface;

- "Internet. “Wallet” is an account with which transactions are carried out using a special program. Its development was stopped in 2011.

Currently, new users can only open Yandex. Wallet."

Yandex.Money users can pay for housing and communal services, pay for fuel at gas stations, and make purchases in online stores.

The advantage of Yandex.Money is the absence of commissions for most purchases and account replenishment. For transactions within the system it is 0.5%, and for withdrawals – 3%. Yandex.Money partners, when accepting payments and withdrawing funds, can set commissions at their own discretion.

Significant disadvantages are the inability to conduct business activities through the system and strict limits on the amount of payments.

You can top up Yandex.Wallet in several ways:

- converting electronic money of other systems;

- by bank transfers;

- through payment terminals;

- depositing cash at points of sale;

- through the Unistream and Contact systems;

- from a prepaid card (cards have now been discontinued, but activation of previously purchased ones is possible).

You can cash out the electronic money system in this way:

- transfer to a card or bank account;

- receiving from a Yandex.Money card at an ATM;

- through the transfer system.

The main share of the electronic money circulation market in Russia falls on WebMoney and Yandex.Money; the role of other systems is much less significant. Therefore, we will consider only their characteristic features.

"PayPal"

"PayPal" is the world's largest electronic payment system, created in 1998 in the USA and has more than 160 million users. It allows you to receive and send transfers, pay bills and purchases.For Russian participants, accepting payments became possible only in October 2011, and withdrawals have so far been carried out only to American banks. These circumstances significantly reduce the popularity of the system among domestic users.

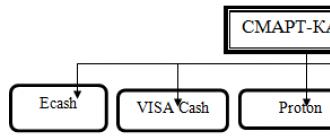

There are two main groups of electronic money, which are divided by type of media (Figure 8).

Rice. 8

Smart cards are multi-purpose plastic cards with built-in chips (microprocessors).

A money file is recorded on their chip - the equivalent of money previously transferred to the issuer of these cards. Bank clients transfer money from their accounts to smart cards, transactions on which are carried out within the limits of the amounts credited to them. The mode of maintaining a personal account for a smart card differs from the mode of maintaining a personal account for traditional cards. A regular card itself does not contain information about the account status; it is only a tool for accessing a current account. At the moment the bank credits funds to the card account to which a regular payment card is linked, no credit is made to the bank card itself. When the smart card is topped up, the balance on the personal account is reduced by the amount by which the card was topped up. Electronic cash appears on the card, as a result of which it becomes possible and safe (from the point of view of the occurrence of an overdraft on the account) to authorize transactions offline. Examples of such maps are presented in Figure 9.

Rice. 9 electronic money based on smart cards

Smart cards have their advantages and disadvantages (Figure 10).

Rice. 10

An example of a successful payment system in Russia is ASSIST. It went through its formation stage together with the famous and most popular online store in our country OZON.ru. Its uniqueness is that it provides modules for electronic stores that help accept all types of payment means - plastic cards, Yandex.Money, WebMoney, as well as its own cards based on the assistid number. Thus, electronic money based on smart cards represents monetary value stored on multi-purpose bank cards in virtual form. This value can be used to make payments to the card issuer, individual or entity. Currently, smart cards issued by non-bank organizations, such as telephone, medical or transport cards, have become widespread. Typically, these cards are used to pay for the services of only one company.

Network-based is electronic money that operates on the basis of a software system presented in the form of a program or network resource. These systems widely use data encryption and electronic digital signatures. This type of payment is widely used to pay for goods from online stores, services of remote workers, or playing time in online games. An example of these systems is WebMoney, Yandex.Money, RUpay, E-gold, E-port, PayCash, MoneyMail, CyberPlat, Rapida, QIWI, [email protected], etc.

This money is currently the most common, most convenient and secure means of payment.

Network-based fiat and non-fiat electronic money are distinguished (Figure 11).

Rice. eleven

Now let’s look at fiat electronic money using PayPal as an example.

The PayPal payment system is quite well known in Russia, although it does not work with Russian clients. It is a debit system using the concept of electronic money.

PayPal has two main types of accounts: for US citizens and international (for non-US citizens). An account for US citizens provides greater opportunities, but requires disclosure of information about the client, down to the taxpayer registration number. Quite a lot of foreign online stores and service companies are connected to PayPal. Therefore, some Russian citizens connect to the system by distorting their registration data (substituting non-existent addresses in Europe, the USA, etc.). This method is unsafe and is not recommended for use. The payment system has more than 100 million customers all over the world and accepts payments from VISA and MasterCard credit cards and necessarily insures the payment. PayPal is the largest online payment system. A huge number of online stores and online auctions trade through it. A buyer who paid for a purchase through PayPal and was deceived by the seller can open a dispute and demand a refund from PayPal. That is why cases of fraud when working through this payment system are very rare. A huge number of sites accept payment via PayPal and credit card.

Fiat electronic money also includes: the African payment system “M-Pesa” - this system operates in Kenya and Tanzania and is a payment service provider and the Ukrainian electronic payment system GlobalMoney (GlobalMoney).

Now let's move on to consider network-based non-fiat money. Electronic non-fiat money is an electronic unit of value of non-state payment systems; accordingly, issue, circulation and redemption occur according to the rules of non-state payment systems.

In Russia, there are such electronic payment systems as WebMoney, Yandex.Money, Qiwi, RUpay, E-gold, E-port, PayCash, MoneyMail, CyberPlat, Rapida, etc. Most systems are not anonymous or partially anonymous. Almost any online store offers payment for goods through these systems.

Each user chooses the most suitable option.

This can be compared, for example, with a cellular operator. In order to choose the right campaign, it is recommended that you familiarize yourself with all the types of mobile operators offered, their rules, the amount of commission they charge for completing a transaction, in turn, some campaigns provide bonuses for using their system.

Of course, often, users choose their most popular system and believe that it is better than others, the most optimal. Since this type of system will have fewer problems with depositing/withdrawing funds, it is supported by many Internet resources. Such a system includes WebMoney. This system is the most popular on the Internet today and has a very high degree of protection, and therefore users practically do not worry about the safety of their money. It is gradually joining the financial market - with the involvement of WebMoney, they are already conducting auctions, selling shares, precious metals and many other operations.

The second most popular type of electronic money is the well-known Yandex.Money system. Its main difference from the WebMoney system is that it has one universal account, which is measured in rubles.

The next QIWI Wallet system is a payment system that allows you to make payments for services and money transfers from a mobile phone operating in the GSM standard. The system allows you to pay for a mobile phone, Internet access, pay TV and many other services without interest and commissions anywhere , where GSM phones work.

The legal space of the QIWI Wallet system is the Russian Federation. For payments in the system, the electronic currency Mobile Wallet RUB is used, the equivalent of Russian rubles.

Let's consider the most well-known payment systems listed above (“Webmoney”, “QIWI”, “Yandex.Money”): on what principle do they operate, what functions do they perform in comparison (Table 7).

Table 7 Comparison of the most famous payment systems in the Russian Federation

|

Yandex money |

|||

|

Client location restrictions |

No restrictions, open for use, cross-border |

Instant payments regardless of location |

No restrictions |

|

Anonymity |

Not anonymous |

Anonymous with restrictions and identified |

Anonymous, except for entering a mobile phone number |

|

Confidentiality |

Availability of a built-in message encryption algorithm. With its help, all users of the system have the opportunity to correspond through secure channels. |

Confidentiality is present, all payments are also protected |

Advanced software allows you to control each payment and ensure the safety of financial resources in the system |

|

Wallets |

WMZ -- dollar wallets; WMR - ruble wallets; WME - wallets for storing euros; WMU - wallets for storing Ukrainian hryvnia. |

Same type of wallets: Yandex.Wallet and Internet.Wallet |

Same type wallets with multicurrency - support for various payment methods (cash, non-cash, electronic currencies, bank cards). |

|

Interest charged |

Transfer within the system - 0.8% (maximum 50 conventional units for WMZ and WME, 1500 for WMR, 250 for WMU, 100,000 for WMB, 55,000 for WMY and 2 for WMG, % charged by banks, terminals, etc. |

Transfer within the system - 0.5% Electronic money exchange - 3% Wallet replenishment - % charged by banks, terminals, etc. |

Transfer within the system - 0% Transfer from a QIWI card - 0% Replenishment of a wallet - 0% (when depositing > 500 rubles), % charged by banks, terminals, etc. Commission for payment and transfer is 3% |

|

Peculiarities |

Various types of wallets: light, classic and others, availability of the well-known exchange office RoboxChange |

Client terminal-Java-application; banking system Contact |

Contact banking transfer system, managing an Internet wallet from a computer using specialized software |

So, with the help of electronic money you can make purchases in online stores, pay receipts, mobile and landline communications, programs, deposit money into your account on social networks, online games, buy coupons, air and railway tickets, make money transfers and much more. other.

For this purpose, there are two types of electronic money (smart card-based and network-based). Using existing types of electronic money is not difficult. Just log into your account, select the desired operation, enter the required amount and make payment

As a result, we can say that the choice of system depends entirely on the user, therefore, you should give preference to the campaign you like, pay with electronic money and not worry about its safety. If treated with care, they will not disappear anywhere!

Term electronic money(and electronic cash, or digital cash) refers to transactions of funds carried out through electronic communications. Electronic money can be a debit or a credit. Digital cash can be a form of currency, and to start using it, you need to convert some amount of regular money into digital money. This conversion is similar to purchasing foreign currency.

Electronic money:

- are not money, but are either checks, or gift certificates, or other similar means of payment (depending on the legal model of the system and the restrictions of the law).

- can be issued by banks, non-profit organizations, or other organizations.

The fundamental difference between electronic money and ordinary non-cash funds: electronic money is a means of payment issued by an organization (money surrogate), while ordinary money (cash or non-cash) is issued by the central state bank of a particular country.

The term electronic money is often used inaccurately to refer to a wide range of payment instruments based on innovative technical solutions in the field of retail payments.

Digital Cash

Digital cash is electronic money that will be issued by the states themselves.

Market of electronic money systems in Russia

2012: Yandex.Money rules the market

2011: Law 161-FZ "On the national payment system"

On September 29, 2011, Federal Law No. 161-FZ “On the National Payment System” of June 27, 2011 became key for the industry, which established the definition of electronic money (EMF) and established key requirements for the transfer of EMF, as well as electronic money operators. If earlier activities were regulated by many laws and individual articles in various laws, then the law “On the National Payment System” has become a single regulatory document for the entire electronic payment industry.

2012

The identification system for users of electronic wallets can be tightened. This was stated in November 2012 by the head of the Bureau of Special Technical Events (BSTM) of the Russian Ministry of Internal Affairs, Alexey Moshkov. According to Alexey Moshkov, the use of anonymous payment systems greatly facilitates the activities of fraudsters, since in some cases the personification of the holder of a virtual wallet is difficult or impossible.

“Criminals use anonymous payment systems to collect and cash out funds, distribute and confuse financial flows. In addition, such virtual wallets are used for the anonymous purchase of prohibited goods and internal payments between members of criminal groups.”

Legal and economic status of electronic money

From a legal point of view, electronic money is a perpetual monetary obligation of the issuer to bearer in electronic form, the release (issue) into circulation of which is carried out by the issuer both after receiving funds in an amount not less than the amount assumed by the obligations, and in the form of the loan provided. The circulation of electronic money is carried out by assigning the right of claim to the issuer and gives rise to the latter’s obligations to fulfill monetary obligations in the amount presented by electronic money. Accounting for monetary obligations is carried out electronically on a special device. In terms of their material form, electronic money represents information in electronic form that is at the disposal of the owner and stored on a special device, usually on the hard drive of a personal computer or a microprocessor card, and which can be transferred from one device to another using telecommunication lines and other electronic means of information transmission.

In an economic sense, electronic money is a payment instrument that, depending on the implementation scheme, has the properties of both traditional cash and traditional payment instruments (bank cards, checks, etc.): cash has in common the possibility of making payments without banking system, with traditional payment instruments - the ability to make cashless payments through accounts opened with credit institutions.

Types and classification of electronic money

There are 2 types of electronic money:

- Electronically issued payment certificates, or checks. These certificates have a specific denomination, are stored in encrypted form, and are signed with the electronic signature of the issuer. During settlements, certificates are transferred from one participant in the system to another, while the transfer itself may occur outside the framework of the issuer’s payment system.

- Entries on the current account of the system participant. Calculations are made by debiting a certain number of payment units from one account and depositing them into another account within the payment system of the electronic money issuer.

Electronic money schemes:

- which implement technology for transferring information electronically about monetary obligations issuer from the device of one holder to the device of another holder. These include Mondex (developed by Mondex International, owned 51% by MasterCard and 49% by the largest banks and financial institutions around the world) and the eCash network product from Digicash.

Among the world's well-known electronic money operators are:

Unlike ordinary non-cash money, electronic money

We've released a new book, Social Media Content Marketing: How to Get Inside Your Followers' Heads and Make Them Fall in Love with Your Brand.

Electronic money is a virtual currency that is equivalent to regular cash or non-cash funds and does not require opening a bank account.

In fact, this is money, the circulation of which occurs not in the form of paper bills, but through the introduction of computer technology and a modern communication system into the sphere of financial settlements.

At first glance, electronic money looks like non-cash payments, but this is not entirely true. Non-cash funds were originally familiar monetary units that a person, for example, deposited in a bank account. After which they turned into his working capital within the banking system.

Electronic money is initially a form of money whose storage is the Internet. They can be used by a person to pay for goods on the Internet or transferred to a bank card for cash withdrawal or non-cash payments. One electronic monetary unit is equal to a fiat monetary amount.

Flaws

Now the fly in the ointment.

- Not everywhere you can pay with this currency.

- There is usually a fee for transfers to wallets of other systems.

- Internet addiction: no Internet - you can’t use it.

- Electronic currency is not regulated by the government.

- Limitation on the size of transfers, cash withdrawals, etc.

Now the issue of using electronic money is relevant. Business is increasingly conducted via the Internet, and you can’t live without such currency.