They appeared recently. Every day there are more and more opportunities for their use. The first and most active application systems were electronic payment systems. PayPal is considered one of the earliest, although it was not the first.

The owners of the resource, while no one really knew what PayPal is, decided to sell it to the eBay online auction. And it was a win-win option. After all, all purchases on eBay made through PayPal are not subject to an additional commission.

In addition, the payment system has developed one of the most effective principles of information security. Due to this, all payments made through PayPal are not only encrypted, but also insured in case of purchase of low-quality goods or goods that do not correspond to the expected type. In other words, if you do not like what the courier company delivered, you can not contact eBay. Just contact PayPal for a refund.

E-commerce in Russia

Electronic systems are not limited to a list of 10 companies that you may be aware of. Every year hundreds of electronic payment systems are born. The same amount every year does not withstand competition.

In Russia, over a decade and a half, only a few companies have stood the competition. Among them, the most popular were WebMoney, Yandex.Money and RBK Money. But their disadvantage is still the impossibility of paying bills of Chinese or American online stores. And if there is such an opportunity, then transactions are subject to large commissions.

PayPal entering the Russian market

Due to the fact that the system operates in more than 190 countries (which is 85% of all states and 95% of the world’s territories), it is international. The ability to convert and transact 24 currencies makes it unique.

Unfortunately, PayPal in Russia does not have a full package of services due to the recent entry into the market, namely in 2013. But due to the high demand in 2016, it is planned to sign an agreement for the supply of goods through the Russian Post, which will significantly reduce the cost of delivery and allow you to order medium as well as small batches of goods.

Unfortunately, PayPal in Russia does not have a full package of services due to the recent entry into the market, namely in 2013. But due to the high demand in 2016, it is planned to sign an agreement for the supply of goods through the Russian Post, which will significantly reduce the cost of delivery and allow you to order medium as well as small batches of goods.

Advantages over programs available in the CIS

When choosing an electronic payment system, it is always worth first of all to pay attention to exactly what is the purpose of registration. If you just need to get paid for Internet activities, especially on Russian sites or CIS sites, then the already considered popular resources will be more than useful and convenient for you.

What is PayPal:

- Consumer protection and purchase insurance.

- An international system that allows you to make financial actions around the world with a minimum commission.

- PayPal money is official electronic money. Currency WebMoney - title units that can be equated to stocks and bonds. They have their own cost, but since no electronic debit system is approved in the CIS, except PayPal, only this company can give guarantees.

- The card and bank details are filled in only once, together with the CVV2 code. PayPal transfer does not require additional information, except for the confirmation of a one-time SMS password.

- Instant payment and withdrawal of funds.

Register for PayPal

In order to successfully make purchases, issue and pay bills, you need to create your PayPal wallet. To register, simply enter your Email and create a password.

In general, the entire authorization process is very similar to creating an account in WebMoney - even easier. Each step is accompanied by hints, and the web interface is concise and clear.

In general, the entire authorization process is very similar to creating an account in WebMoney - even easier. Each step is accompanied by hints, and the web interface is concise and clear.

There will be no redirects, so all you need is a reliable email address. It does not matter where your mailbox is located, on Yandex on or Gmail - this will not affect the activation process.

Next, you need to determine which card to attach to the wallet. If your card is not supported by the system, which is very likely, then PayPal simply will not tie it to your wallet. If so, do not despair, because you can easily find a list of all the banks with which the system collaborates in your country. This list is constantly updated and updated.

If you prefer any bank, then take an interest in his nearest branch about plans for cooperation with electronic systems.

Making a purchase with PayPal

This system works as a support for so many Internet resources. For example: buying and selling goods in online stores, paying on international survey sites or receiving funds for the work done by a freelancer, and so on. If you have previously encountered payment through the Internet banking of your bank, then the same rules apply here.

An important difference is that to pay for any product you need to know not the account details or the card of the recipient, but just an email address. If you corresponded by Email, then before sending money, it is better to clarify the email address to which the recipient's PayPal account is linked. Do not forget about it!

A freelancer can be transferred to a PayPal account in a completely similar way.

A freelancer can be transferred to a PayPal account in a completely similar way.

Cash withdrawal to an attached account

First of all, it is worth noting that according to the level of access to services, all countries and, accordingly, customers are divided into three types:

- full access to all functions;

- buying and selling through the system;

- only purchase (i.e. only payment).

If the first and second types allow you to cash out the money you earned, then in the third case it is possible to cash in kind, so to speak, that is, through the purchase of another product on eBay. All CIS countries, except Russia, can only make purchases and dispute the seller’s incorrectness in case of defective goods. That is, money can be spent and receive a refund either full or partial (depending on the conditions of purchase).

Since 2015, PayPal in Russia allows you to withdraw funds to your personal bank account with preliminary conversion, if this account is opened in rubles. Conversion occurs mainly from the euro or the US dollar.

How to tie an account

It’s worth mentioning right away that attaching an account and a card are two different possibilities. Usually the account holder has only one card, but there are cases when one of the spouses makes two cards in one account so that the other can use it. This is just a special case, but there is a need for separation, and PayPal fulfilled this condition in favor of customers.

As at the very beginning, when registering, when you indicated and confirmed your debit card, the same procedure must be carried out with the account of the second card. After all the relevant confirmations and test payments that are returned to your account, you can continue to work, transfer your funds to any other PayPal account or spend everything on a new collection of sports sneakers, for example.

As at the very beginning, when registering, when you indicated and confirmed your debit card, the same procedure must be carried out with the account of the second card. After all the relevant confirmations and test payments that are returned to your account, you can continue to work, transfer your funds to any other PayPal account or spend everything on a new collection of sports sneakers, for example.

Paypal here

Situations are completely different. A laptop can also not always be dragged along, but you need to work through the system. In order to transfer funds and make a purchase, there is absolutely no need to carry a computer with you. Just install PayPal Here on your phone.

What is PayPal Here? This is a program that can be downloaded from Google Play or the Apple Appstore to make instant payments. Since 2015, PayPal Here has released a special card reader that can be connected to the phone through the headphone jack.

Thus, the phone turns into a portable terminal.

Deviations while trying to snap a map

Earlier, you already managed to find out that there may be cases when the card is not suitable for registration in PayPal. The reasons for this may be different, and they will probably be reported to you from the bank by phone or statement. But the most common and primitive ones are, firstly, the limit on online purchases (most likely, it is zero, because during registration, in order to check the card account PayPal blocks $ 1, which then, of course, returns back), and in -second, the limit for online purchases may be exceeded.

Both the first and the second are solved in 5 minutes with one call to the technical support of your bank.

Both the first and the second are solved in 5 minutes with one call to the technical support of your bank.

Paypal versus webmoney

You have already figured out what PayPal is: successfully passed registration, verification and other procedures. But before that, everything was done in the WebMoney system.

How possible is it to withdraw funds to PayPal with WebMoney and vice versa? The answer is very inspiring, because the circulation of funds between these systems is completely real in both directions. To do this, just create an appropriate application in WM Keeper for exchanging WebMoney title units for equivalent electronic currency in a PayPal wallet.

Application as usual will be processed within 24 hours. This is the only time that PayPal payment will take longer than a few minutes.

What can I buy with PayPal?

A system that covers the whole world simply has to be universal in all corners of the Internet. Unfortunately, many companies cannot afford such cooperation, because, in fact, PayPal is (was until 2015) the property of eBay, while its direct competitors are AliExpress and others. Therefore, many competing companies do not have the right to use this resource.

Despite this, a large number of ads registered on AliExpress offer an option such as PayPal payment. Since the company received independence from eBay only in 2015, it has not yet managed to acquire mass production on other resources. But, given the low survivability of any electronic payment system, the prospects for PayPal are even greater.

As previously reported, the prospect of PayPal in Russia and throughout the CIS is clear and cloudless. Entering the European market and approving the system at the legislative level as recommended for financial transactions only strengthened our positions and allowed us to develop our work in the direction of the Near and Far East, as well as the vastness of the Russian Federation.

As previously reported, the prospect of PayPal in Russia and throughout the CIS is clear and cloudless. Entering the European market and approving the system at the legislative level as recommended for financial transactions only strengthened our positions and allowed us to develop our work in the direction of the Near and Far East, as well as the vastness of the Russian Federation.

Following this, it is planned (in 2017) to update PayPal in Ukraine, Belarus and Kazakhstan. And consequently, such changes will entail the rapid development of medium and small businesses, which will lead to positive changes in the economy of the whole country.

Summarize

In this short article, we discussed in detail one of the most famous international payment systems that are constantly used in different countries of the world, including the Russian Federation, Ukraine, Belarus and the United States of America. Also, the article dealt with purchases made using this system, about the main problems that an inexperienced user might have, and about quick ways to solve such nuances. By the way, we also touched on the topic of special applications for various mobile phone operating systems, thanks to which you can use PayPal anytime, anywhere.

If you were looking for detailed information about the best international payment system in the world, you have found it. The article presented to you contains information confirmed by official sources, including the official PayPal website.

GENERAL ISSUES

What is PayPal and what does this company do?

"What is PayPal?" - This is the first question that arises for anyone interested in this system, so we’ll start with him. PayPal is an American company that holds a leading position in the global Internet payment market. It works in 203 countries of the world, operates with 25 currencies and has more than 230 million active users. It is characterized by simplicity and at the same time a very high level of security, which is especially important when conducting financial transactions. The literal translation of the name is "pay a friend" (pay - pay, pal - buddy) .

I have a bank payment card, why do I need PayPal?

There are many reasons. We name the main ones.

First is convenience. Sending and crediting funds occurs instantly. In one click, you can send money to the other end of the globe, because PayPal is known and accepted everywhere, unlike other electronic payment systems (such as, for example, Webmoney, popular in Russia).

You can freely pay for goods at any of the regional branches of the ebay auction and in hundreds of other foreign online stores, including where certain difficulties may arise when paying directly with a payment card issued in the Russian Federation, Ukraine, Kazakhstan, etc. . The fact is that many stores are especially attentive to orders from countries where the level of payment card fraud is high, and they may well either request copies of the card and passport, or cancel the order. When paying through PayPal, such "amenities" are guaranteed to be avoided. Buyer use of PayPal is believed to be an essential security guarantee.

In addition, you do not need to enter your bank card details and delivery addresses each time - just log in when placing an order in your PayPal account. At the same time, residents of the Russian Federation and the Baltic countries can receive funds to their Paypal accounts - both personal payments and payment for sales.

Secondly, security. Have you ever been robbed? Is this feeling of anger and powerlessness familiar? No matter how much effort banks, security certificate developers, shops and payment systems work on while securing transactions, it is still impossible to say even with 50% certainty that attackers will not be able to steal bank card data at some point and simply rob it owners. Even large, respectable trading floors periodically report the theft of customer data. Search the news!

And the easiest way to “lose” data is when paying in small, unfamiliar online stores. What can I say, sometimes cunning scammers deliberately create clones of pages of well-known stores or entire stores to fetch data from inattentive customers.

In case of payment via PayPal, payment card data is not transferred anywhere, and the service itself is, in fact, one of the most secure portals in the world. Huge amounts of money are spent on maintaining its safety and the world's best specialists work. Therefore, when paying for an order through PayPal, you can sleep peacefully.

Thirdly, the protection of the buyer from unscrupulous sellers. Protection Tool - Dispute , which is available to every Paypal client, helps in case of problems during the transaction at all stages. It will allow you to return the funds paid in full or in part if the goods are not received or does not match the description. Anyone who encountered problems during the transaction will confirm how useful and necessary the tool is in online trading. The main principle of the dispute is impartiality, on the basis of which the operation algorithm is prescribed. PayPal is very strict about observing its rules, therefore all sellers accepting funds from buyers through this payment system are very disciplined and go to resolve disputes with customers as soon as possible. For the seller, a ban on receiving funds through Paypal is a disaster.

Fourth, flexibility. If you live in a country where it is allowed to accept funds to your account balance, you can turn PayPal into a full-fledged financial gateway for conducting international business in the most secure and transparent environment.

I already use the payment system Webmoney, Yandex. Money, QIWI, etc. Why do I need PayPal?

PayPal is accepted by thousands of online stores around the world. But so far little is known about Russian electronic payment systems abroad and units of trading floors work with them, mainly in China.

Living in Russia, Ukraine, Kazakhstan or another country of the former Union, can I use PayPal and to what extent?

You can determine whether the payment system works with a particular country and to what extent directly on the PayPal website. Countries with which it works Paypal, are conditionally divided into two groups: the first is allowed to send and receive funds, as well as withdraw them to a bank account, the second group is only allowed to send funds from payment cards tied to an account.

Countries whose residents are allowed to send, receive and withdraw funds:

- the Russian Federation

- Kazakhstan

- Latvia

- Lithuania

- Estonia

- Georgia

- Moldova

Countries where PayPal works only for sending:

- Ukraine

- Belarus

- Armenia

- Azerbaijan

- Turkmenistan

- Tajikistan

As you can see, almost all countries of the former Union, with the exception of the Russian Federation, Kazakhstan, Georgia, Moldova and the Baltic countries, belong to the second group. To quickly understand whether PayPal allows you to accept payments and create business accounts in your country, just select the country and look at the upper left corner of the site. If, in addition to the Buy and Send buttons, there are also Sell and Business, then you can work in full.

Is there a Russian interface available in PayPal and is there support in Russian?

PayPal has a full Russian interface. When accessing the site from a Russian IP address, the system will automatically install the Russian language. If you are from another country, but want to use Russian, simply select the language by clicking on the appropriate check box. English can also be selected at any time from the drop-down list in the upper right corner of the authorized account page. The Russian-speaking support service is available for accounts registered from Russia by calling 8-800-3332676 (Mon - Fri from 10:00 to 20:30 Moscow time) and through the feedback form by e-mail.

Some foreign online stores and sellers on ebay do not accept payment via Paypal. Why?

There are several reasons. Some sites, such as Amazon or Aliexpress, do not work with Paypal, because ebay, to which this payment system is most directly related, is their direct competitor.

Many European stores and sellers on ebay do not work with Paypal because of the rather high commission that the system charges (5-7%). A bank transfer within the EU will be much cheaper, sending it is also simple, and it will take some hours to transfer funds.

I do not have a laptop, I want to work through a mobile phone or tablet. How should I do it?

It is enough to download the PayPal mobile application for Android or iOS mobile platforms from PlayMarket or AppleStore, enter the login, password for your account (or register a new one if it is absent) and use all the tools anywhere in the world where there is Internet access.

Does Paypal transfer data about payments received by the user to the tax authorities?

If the turnover is significant, then data on received payments can be transferred to the tax authorities. In any case, be prepared for this.

REGISTRATION

Which email account should I use to work with PayPal?

Anyone can do it, but for security reasons it is better to create a separate mailbox specifically for working with payment systems - with a password that is different from other services. Give preference to the most secure email services such as Google Gmail, Microsoft LIVE, Yahoo Mail. Email address will require confirmation. You can get more detailed information on this issue in our article: Paypal. Registration .

Pay particular attention to the email address when opening business accounts. It is the address of your mailbox that will be the ID in the PayPal system and customers will see it. Therefore, it will be optimal to include a trademark in the "name" of the mail and use an email address registered not on a free service, but in the domain zone of your website.

What type of PayPal account should I open? When registering, I was offered a choice of two types of accounts: "Personal" and "Corporate". Which one to choose?

If you are an individual and are only going to buy and receive transfers from friends and relatives, choose " Private". If you want to use PayPal as a business tool, choose." Corporate"(you must have a legal entity registration)." Personal "account can always be changed to" Corporate ".

What language to enter registration data in?

Is PayPal registration free?

Registration, opening and maintaining an account, as well as sending payments are completely free for any type of account.

In what currency should I open an account?

PayPal offers a choice of working with 26 different currencies in which you can open an account. But due to the peculiarities of legislation in certain countries, opening an account is possible only in national currency. With regard to Russia, this rule applies in part - initially the account is opened in rubles and funds can only be withdrawn to ruble bank cards, but it is possible to add any of 25 account management currencies. As a rule, users from countries of the former Union open an account in either US dollars or euros. To reduce conversion losses, it is better to tie cards denominated in the currency in which most transactions will be made.

My country is not in the list, i.e. do not work with my country? Maybe I need to specify another country?

Yes, this means that PayPal does not work with your country. It is not worth registering using falsified data, as sooner rather than later, your account will be closed, and the funds available on the balance sheet will be frozen. In this case, intermediary firms will help.

Can I change the e-mail - account identifier after registration?

Yes, it can be done.

I registered, entered the details of the card and, via SMS banking, they informed me that the amount equivalent to $ 1 was blocked on the card, how do I understand this?

To authorize a card and check its validity, the system without fail requests a sum of $ 1 and blocks it on a payment card. This is a normal procedure, funds will not be debited and will become available after some time.

During the card verification procedure, $ 1.95 was blocked on it; how to return this money?

I went through the registration process to the end, however, once I got into my account I saw that I have 0.00 on my balance, although is it normal on the card that I used when registering, is this normal?

Yes, this is a distinctive feature of accounts from which only funds are allowed to be sent. The balance will always be zero, and money is withdrawn from the card if necessary. If you are allowed to accept funds (for example, you live in the Russian Federation), then on the account balance there will be funds debited from the card during verification - $ 1.95.

I am not 18 years old, can I register at PayPal?

If you have a payment card suitable for online payments, then of course you can, no one will carefully check this moment. But in case of disputes, when verification may require the provision of copies of identification documents, there is a risk of problems, as the rules prohibit the registration of minors. An alternative is to register through parents or older relatives. In no case under the age of 18 do not register business accounts if you intend to trade and accept payments.

I live in one country, but am a citizen of another. Which country to choose upon registration?

Unambiguously choose the country that issued the passport, a copy of which you can provide if you have questions. If in the country of temporary residence there are documents equivalent to a permanent residence permit and there is a bank account with cards, then you can easily register an account with the available data. Otherwise, such actions may be considered falsification of data and you simply lose the money remaining on the account that was blocked at some point.

This issue is especially relevant when opening an account to accept payments.

Can I open a second PayPal account in my name?

Yes, the user can open a second account in his name - to have two accounts (but no more!) Does not contradict the rules. This is usually done when opening a business account. However, at the opening, the following conditions must be met: another email address for registration, another payment card.

If your account was blocked for one reason or another, then opening a new one does not make sense, because it will also be permanently blocked.

On the main page of my account there is information that my account is "Unverified". What does it mean?

PAYMENT CARDS

Is it necessary to have a payment card for registration and work with PayPal?

You can register without a card. But further work with the payment system depends on the country in which you live, since the working conditions of PayPal vary greatly depending on this point.

How to top up PayPal with a Russian bank card?

PayPal allows you to replenish the balance only by bank transfer, direct transfer from friends, relatives, customers, cashback services, counterparties. And, of course, the question of how to replenish PayPal is relevant only for users from those countries in which this opportunity is open.

Which payment card should I choose to work with PayPal?

Can I use a payment card opened in euros in a PayPal account opened in US dollars?

The payment system allows you to maintain a balance account in any of 25 currencies, including in euros or dollars. PayPal or the bank - the card issuer (depending on your choice) will convert one currency to another. But do not forget that for them, conversion is a source of system revenue and, if possible, try to avoid it. An option would be to link to the account of a multicurrency bank card and pay from it in the billing currency without bank and PayPal commissions.

Can I use payment cards issued by Payoneer and ePayments when working with Paypal?

Yes, cards issued by ePayments and Payoneer will work without problems.

I found a company that sells the so-called "prepaid cards". Can I use such a card?

We do not recommend you to do this - judging by the reviews, users of such cards have accumulated a lot of negative experience. Often, for using such a card, the payment system security service once and for all closed the user’s account. The main problem is that it is practically impossible to verify the identity of the owner of such a card and, using this, such cards are often used by scammers. To work calmly and stably with PayPal, it makes sense to open a traditional payment card in a bank.

PayPal does not accept my payment card. What to do?

There can be many reasons for this. One of the most common is commonplace: the card does not have the ability to make Internet payments. This problem is solved by calling the bank support service. Most of the other reasons and ways to overcome them are discussed in our article: If eBay, PayPal, online stores do not accept a payment card.

Why verify the entered payment card in PayPal?

Can I use a payment card issued to another person (relative)?

This is completely out of the question. In this case, the account must be opened in the name of the person whose card will be used, and you should have access not only to the documents of that person, but also to his bank account (Internet banking).

PayPal sent a reminder that my card is expiring. What should I do?

Link another bank card to your account and verify it, or change the validity period of the old card - when the card expires, many banks automatically reissue the card with the same number, but with a new validity period.

SENDING PAYMENTS

In what currency do I send the payment?

In the one in which the invoice is issued (invoice). When sending payments in Russia, choose rubles, and when sending an international payment - the currency of the country of the payee.

How fast are payments processed?

Usually within a minute.

What you need to know to send a payment?

You only need to know the identifier of the account of the user to whom you want to send the payment. This identifier is the email address of the recipient.

Can I cancel a transaction?

Only at the initiative of the recipient, who can return the payment to you.

Is it possible to transfer with a protection code?

No, this is not provided.

Do I need to replenish my account balance to send payments? What methods of transferring funds exist in PayPal?

Depending on the country of residence and working conditions of PayPal in this country. Typically, the payment system works as a gateway between your account-linked card and the recipient. You can replenish the balance in the Russian Federation, Kazakhstan, Moldova and other countries of the former Union, the residents of which PayPal allows you to accept payments, only by receiving payment from another user. Self-replenishment is not provided.

There are several ways to transfer funds in PayPal:

- With a payment card attached to your account.

- From the balance of your PayPal account.

In any case, the funds to the recipient are credited to the account balance.

When sending a payment, I received a message that the recipient is "Can not accept payments."

This means that either he lives in a country whose residents cannot receive payments through PayPal (Ukraine, Belarus, etc.), or his account is blocked.

I heard that PayPal limits its users to some kind of limits?

There are several types of limits that are imposed on users according to various criteria (country of residence, type and status of account verification).

The limit is imposed on a single operation - payment / withdrawal, account balance, all operations within a month.

Limits are imposed on the volume of cash transactions and directly depend on the status of the account - unverified, partially confirmed with verification of a credit card and fully confirmed with verification of a credit card and sending a copy of a passport (verified).

For an unverified account, a limit of 60,000 rubles is set on the balance sheet and any one-time operation for the same amount; monthly turnover is set at 200,000 rubles or the equivalent in US dollars. For a fully verified account, all restrictions on the monthly turnover are removed; the transaction amount increases to 550,000 rubles and the limit on the account balance increases to the same amount. For business accounts, if you exceed the balance account limit of 550,000 rubles, funds will be automatically transferred to your bank account.

How to remove transaction limits for a PayPal account?

On the page of your account, find the line "Check limits of my account", on the page that opens, find the button "Increase limits" and then proceed according to the proposed algorithm, i.e. add and confirm a bank card, confirm personal data by sending a scan copy of the passport spread (TIN is optional). Consideration of an application for an increase in limits takes 5 days.

Why can’t I choose a delivery address in a different country than that indicated at registration?

This is an invariable rule. for account holders in some countries, which creates quite a lot of inconvenience: there can be many delivery addresses, but all of them should be located only in the country of user registration. If this restriction applies to you, the system will notify you when paying.

The way out of this situation is to choose another payment method or to seek help from an intermediary company.

The exception is payment on ebay: regardless of whether your account has a restriction on sending an order to another country, you can pay for the order with any delivery address.

Why is a large amount withdrawn from my card than the one I am sending?

The reasons may be different and you have to figure it out. First, pay attention to the currency of your card and the currency of the payee: if they differ, the card issuing bank takes various fees: for each transaction, transaction outside the card issuing country, conversion, etc. You can also add the moment that Paypal itself converts the funds sent to the currency of the payee, and the conversion fee is usually much higher than that of the bank. Secondly, this is the commission of the system itself. For example, transfers from an account to a PayPal account in Russia are free of charge, and transfers from an account in Russia to an account abroad will already cost from 0.4 to 1.5% of the transfer amount, using a card already 3.4% + 10 rubles.

The system converts the funds sent at an extremely disadvantageous rate - can I make it so that the payment is converted by my bank, not PayPal?

Yes, such an opportunity is provided. To change the conversion center, you need to perform a simple algorithm of actions, which we outlined in the article: Conversion of funds when working with PayPal.

ACCEPTANCE OF PAYMENTS

I received a payment from the buyer, but I can’t operate with funds. Why?

"Freezing" a payment or hold is a feature common to all new PayPal accounts engaged in online business. This is due to a certain distrust of the system to "beginners". Usually, “freezing” takes 21 days, even if the goods have already been received by the buyer and positive feedback / confirmation of delivery is set. "Freezing" can be removed manually by contacting customer support, but no earlier than 3 days after receiving a positive review / confirmation of delivery. If the volume of trade is large enough and turnover grows over time, then the hold is withdrawn during the first year of doing business. With long interruptions in work, the hold is again superimposed. There is information that the hold is withdrawn after reaching 25 successful sales in the United States with delivery confirmation by USPS tracking number.

I received a payment in US dollars, but I received rubles in my Russian PayPal account. Why?

It's all about the status of your account, which is not verified in full. If the status is "Unverified", all incoming payments in the currency will be automatically converted into rubles at the exchange rate of the system. With full verification and setting maximum limits, it becomes possible to open a separate foreign currency account, receive and store money in foreign currency.

The seller wants to return the money to me for the goods paid, but says that the funds cannot be transferred to the PayPal account opened in my country.

Yes, such a problem exists. Indeed, funds cannot be transferred to PayPal accounts opened by customers from many countries of the former Union (except for the Russian Federation, Kazakhstan, Georgia and the Baltic countries), since such accounts serve only as a payment tool.

Paypal provides the service "refund" - refund. If 180 days have not passed since the transaction, the seller can refund either the entire amount paid (full refund), or part thereof (partial refund). Money is returned directly to the card within 3 −10 business days. You can amicably agree on the refund with the seller, but if he does not make contact, act within the framework of the PayPal Buyer Protection program and open a dispute.

I am asked to accept other people's funds into my account balance

In principle, this can be done, but only if you are sure that you know whose money it is and why it was transferred. Otherwise, you may lose your account, because all responsibility lies with you.

WITHDRAWAL OF FUNDS

I live in the Russian Federation, how can I withdraw funds received to my PayPal balance?

In Russia, PayPal allows you to withdraw funds from the account balance only to a bank account in rubles (not to be confused with a card bank account). For withdrawal, you need to open an account in any bank of the Russian Federation in your name or organization, find out the account details - account number and BIC. Next, we act in accordance with our instructions in the articles:

- Adding a bank account of a Russian bank to your account.

Among other things, the funds received can be spent on purchases. But payment for the goods can occur either from the account balance or from the card. If, for example, there are not enough funds on the balance sheet, then the missing balance will not be removed from the card, and the system will give an error.

I live in Kazakhstan. How can I withdraw money from my PayPal account balance?

For account holders from this country, PayPal has two ways to withdraw "Withdrawal" funds - to an account with an American bank (if you get a Payoneer card, for example, you will get such an account) or directly to any Visa card linked to your account. The minimum withdrawal amount is 10 dollars, euros or 0.2 rubles. Fixed withdrawal fee - $ 5.

RATES

How much do PayPal services cost?

Opening and maintaining an account is completely free. The commission of the system and the size depends on many factors: whether a personal payment or payment for a product / service, the country of registration of the account, the type of account and currency, in the same country the sender and the recipient, the funds are sent from the balance or from the linked card, etc. . The average commission is 3-5% of the amount.

When paying for goods, the commission is always taken from the seller. When sending a personal payment, it is possible to choose who pays for the services of the system. You can get more detailed information on this issue at the link: Official tariffs in Russia

CONVERSION

What is double conversion?

The procedure when several automatic currency exchanges are made during the payment before the funds are credited to the buyer. Considering that during each exchange the amount "loses weight" by 4-5%, the results can be quite tangible, especially when paying a large amount.

A classic example of double conversion: a payment card in Euro is attached to a PayPal account, and the transaction is carried out in US dollars. The bank was selected as the conversion center (invoice in the seller’s currency). The bank cannot make a direct exchange of euros for dollars and is obliged to use the national currency. Therefore, he first buys your euro from you (first conversion), and then sells you dollars (second conversion). All this is carried out automatically.

Therefore, try to avoid such exchanges. To do this, customers get cards in national currency, dollars, euros (or one multicurrency). The right card will always be at hand.

DISPUTES AND PROTECTION OF THE BUYER

What kind of protection does Paypal offer customers? What is a dispute?

I paid for the goods and received it inoperative. Opened a dispute, but the seller on ebay is blocked. Will they get my money back?

Yes, you will receive the full amount. In case the seller is blocked or there are not enough funds in his account, Paypal will cover the costs. The maximum declared coverage amount is $ 2500. If you received a letter from ebay that the seller’s account with which the transaction was concluded is blocked, then the dispute is automatically resolved in your favor.

I have been refused payment, the dispute has been resolved not in my favor. What are the options?

You can file an appeal. To do this, just log in to your account, select in the problem resolution center Closed Cases and press the button "Appeal." The case will be considered again, copies of documents and even a statement to the police may be required of you. It is advisable to provide some new data and materials, otherwise the appeal will be resolved, most likely, not in your favor.

But in this case, there is a way out - quite often a statement written to the bank that issued the card helped the customers, regarding whether they were the victim of fraudulent actions. This banking operation is called chargeback. Materials will be handled by the relevant department of the Visa or Mastercard payment system. An application for a chargejack can usually be submitted in the same department where you received your card. It is desirable to clarify this information in the bank support service.

Is the number of open disputes regulated somehow?

No, the number of disputes is not regulated. But if you abuse this tool, then the account of such a user will be blocked. Therefore, use it only if absolutely necessary. Try to resolve emerging issues without resorting to open a dispute.

SECURITY

What is a Confirmed Shipping Address? Why only some sellers on ebay want to send it? How do i get it?

"PayPal Confirmed Address"- the user's physical address, verified and confirmed by PayPal. The address is verified using an algorithm that is not fully disclosed. Sometimes it’s enough to add and verify a bank account, sometimes managers Paypal call the user on the specified phone.

"Confirmed PayPal Address"is available only to residents of the United States, Canada and the United Kingdom. When sending goods to a confirmed address, the Seller uses the PayPal Seller Protection Policy ( PayPal Merchant Protection Policy), which allows you to compensate for losses on any transaction, if the Seller has become a victim of fraudulent actions ( for example, the Buyer made an illegal refund to the bank at the bank, etc.) Therefore, many Sellers make it a prerequisite for the transaction that the Seller has a confirmed address.

It is worth noting that sellers observe this rule quite rarely and, if you have a good rating on ebay, they easily send your purchases to the forwarder's address. Often, even the address provided by your forwarder in the USA goes into the “Confirmed” category after several successful deliveries to it.

Can I log in to my account from different computers?

Sure you can. No one restricts this right. Another question is that the system closely monitors who, where and from which devices comes into your account, monitoring potential fraudulent activities. Frequent authorizations from different devices (MAC addresses) and international IP addresses can lead to temporary blocking of access and additional authorization conditions - up to sending copies of some documents or calls from PayPal support. You need to take this calmly and know that this is only for the good of the safety of your funds.

Q; How do I know any information about a PayPal user by their ID?

Can I give my login and password from the Paypal account to my relative who lives in another city? He wants to pay for his purchases.

If the account is registered to an individual, it is better not to do this. AT the company immediately determine that several people use the account, and the second access can be determined as unauthorized. Such an account will fall into the gray list and will be blocked during regular authorizations from the IP addresses of different cities, and the owner’s identity will be verified.

Business accounts have the ability to simultaneously access multiple people registered in the system to one account.

Can I exchange Paypal for Webmoney or vice versa?

According to the rules of the payment system, the exchange of funds for other electronic currencies (including Webmoney, Yandex.Money, etc.) or vice versa is prohibited. Accounts of users who are found to be in violation of this rule are blocked forever. Therefore, do not be frivolous, because of a small violation you can lose your account.

My account is locked forever, can I open a new one? What can be done at all?

No, in this case you should not even try, because the newly opened Paypal account will also be blocked. This usually happens within a week. Funds in this case are frozen, and payments made may be canceled. Therefore, in order to avoid unnecessary problems, a new account in any form is strictly not recommended to open. It is also impossible to challenge the decision to close.

The only way out in this situation is to ask for help from one of the relatives: ask him to open a new Paypal account, enter his data, address, payment card. In this case, it is advisable not to use your computer to register and work with the newly created account.

Can I close the Paypal account and immediately open a new one?

No. You cannot immediately close your Paypal account. You can only apply for closure. It will be considered, the account will be frozen for 180 days (the period of possible claims) and then it will be closed.

My ebay account is blocked, does it mean that Paypal is also blocked?

No, usually these two actions are not related. Although for serious violations, both accounts can be closed.

My Paypal account was stolen, I can not log in, what should I do?

You need to immediately block the payment cards that are entered into your account and contact PayPal support.

I received a letter from PayPal that access to my account is limited. I looked in my account: in order to remove the limit, they asked me to send copies of documents. What for? Will my scammers not use my documents?

Of course, third parties will not use copies of your documents. It’s just that the security service wants to make sure that you are you, so it asks you to confirm the information entered during registration by sending copies of some documents. You can get more detailed information on this issue from our article: PayPal. If account access is limited (Limited Account Access)

Letters are constantly being sent to different addresses that my Paypal account is blocked and I need to change my password, although I log in to the site without any problems - are these scammers?

Yes, such emails (usually on letterheads) are sent by scammers with one purpose - to force the user to follow the link from the letter to the site, " very similar to the original site"and enter your username and password there, which will immediately fall into the hands of fraudsters. This fraud scheme is very common and similar emails are sent to hundreds of millions. The most popular scammers are users of PayPal, ebay auction, large Western banks (they crack the password for online banking), etc. If you received a similar letter on the form, " very similar"to the branded one, then just forward it to Paypal at: [email protected] ; if you received the same thing on the ebay form - forward it to the address: [email protected] . Good email services like Google Gmail usually send these phishing emails to Spam immediately.

Also, when going to the PayPal site using links from e-mail (which is generally not recommended), pay close attention to the address bar - the URL should start with HTTPS: // (not HTTP: //), and clicking on the green button of the certificate should give a window indicating the type of encryption certificate to whom it was issued, i.e. Paypal and by whom it was issued, as well as the validity of the certificate.

PAYPAL AND EBAY

I buy on ebay and get a PayPal account to pay for my purchases, are there any recommendations in this case?

The country of registration of the ebay account and Paypal must match. There are no other additional recommendations.

How to "link" PayPal account to ebay?

After authorization on ebay, go to the section My eBay (My ebay), where after clicking on the tab Account (Account) you will see a column with links. Line PayPal Account (Paypal Account) is what we need. We click on it and in the window that opens we find the button Join PayPal Account (Link Paypal account). After clicking on it, we will be asked to enter a username and password from your account PayPal We enter the data, click "OK" and now we can pay for purchases "in one click".

Why does the seller write in the description of the lot on ebay that if I want to pay via Paypal, will he include the commission of this payment system in the account?

Indeed, some (especially European) private sellers put forward similar conditions. And nothing can be done with them. The ebay auction, like Paypal, receive the bulk of the profit on commission fees. So, a successful purchase for you is also the need to pay commissions for the seller, which in total amount from 12 to 15% of the transaction amount. The fact that the Seller puts forward a demand to cover his expenses does not characterize him in a good light, but there is nothing illegal in these requirements. If for a large retailer this is just transaction costs, for a small retailer it is a significant minus in the balance sheet. In the end, you can always choose a different payment method.

Why do some ebay stores and sellers accept PayPal payments only from U.S. residents?

Yes, some popular stores and sellers do not accept payments from PayPal accounts registered outside the United States. When trying to pay for a product, the buyer receives a notification.

This is an internal policy, including for security reasons. This information is usually indicated on the store website or in the ebay store. Payment by credit card in such stores is usually also closed (theoretically, you can specify the forwarder addresses in the Billing Address and Shipping Address fields, but no one guarantees that the order will not be canceled) and you can place an order only through an intermediary.

Can I give the intermediary the details of my ebay account so that he enters his Paypal identifier and redeems the goods himself?

Yes, there are no special problems with this. The intermediary will have to add another delivery address in your ebay profile and, using your PayPal account, will pay for your goods. But if it is possible to avoid such a scheme of work, it is better to do this, because in any of the companies, such purchases may be suspicious and block the account for additional verification of the identity of the owner.

Hello dear friends. Today I will tell you how to use the PayPal payment system, how to register, how to fill out and set up a profile, how to add a bank card, an account, how to create a personal page for receiving payments from around the world and how to withdraw money from a PayPal account to a bank account.

PayPal is an international payment system available in more than 200 countries, using this system you can pay for purchases on the Internet, make various payments and transfer money around the world. The system ensures the security of payment and assumes a guarantee of return in case of an unsuccessful transaction between the buyer and seller.

And using a convenient mobile application, all money transactions can be performed directly from your smartphone or tablet.

registration

To register in the system, go to the official website https://www.paypal.com and click on the button "Register".

To register, you must enter a valid email address, come up with a password and confirm it. Then press the button "Continue".

A confirmation email will be sent to the indicated mailbox. To complete the registration, follow the link provided in the letter.

This completes the registration procedure.

To enter your personal account on the main page of the system, click on the button "To come in". Enter your login (mailbox address) and password and you are in your personal account.

Profile Setup

The main page of your personal account is presented with general information where you can immediately see recent transactions, account balance, linked bank cards, accounts and a link to withdraw money from the account.

There are also sections in the form of menu items that contain all the necessary functions for adding bank cards and accounts, issuing bills, creating a personal page, and so on.

And to set up a profile, you need to click on the gear image in the upper right corner of the office.

After going to the settings, fill out the profile data as detailed as possible. This will facilitate many further procedures with identification and other security measures.

Settings are presented in four sections. Do not miss a single one.

It does not make sense to analyze in detail each item, since all of them are extremely clear. In the video tutorial, I will focus on this and show what’s what.

Adding, editing and deleting a bank card

To pay for goods and services around the world using the PayPal system, you do not necessarily have money in the system account. It is enough to attach a bank card, and you can pay with funds from the card. It's like in, only bigger. In this case, the system does not charge additional fees.

To add a bank card, go to the section "Score".

This section presents the balance sheet, attached bank accounts and bank cards.

Click on the icon "Add card".

Then enter the confirmation code from SMS and confirm the card binding.

Now, when paying, your card will be available at your choice.

Also, by clicking on the icon of the attached car, you can edit its data and make a confirmation if you have not done so previously.

To delete a card, click on the map icon, then on the link “Verify Bank Card” and further on the link Delete.

Adding, Confirming, and Deleting a Bank Account

So, if you add bank cards to use them when paying, then you need to add a bank account to withdraw money from your PayPal account.

You can do it all in the same section. "Score". But by clicking on the icon "Add bank account".

In the next step, check the data, if everything is correct, then click "Continue".

The account was successfully added and two small amounts were sent to it. This is necessary to confirm that you are the owner of the account. In the meantime, the account is in status “Awaiting Confirmation”.

Translation can take 2-4 days. Therefore, you need to wait. In my case, the transfer came in 5 days.

When you receive the transfer, you can make an invoice confirmation. Confirmation will provide not only the ability to withdraw money, but also increase the limits. This confirms your identity. You can also make payments from your bank account.

To confirm, you must either on the main page or in the section "Score" Click on the bank account icon. Next, enter the two checksums and click on the button "Confirm".

How to withdraw money from PayPal to a bank account

After the bank account is confirmed, you can withdraw money without a commission.

To do this, on the main page of the cabinet, just click on the link "Withdraw funds".

A transfer to a bank account will be completed within 2-4 business days.

How to create a PayPal.Me page and receive payments from around the world

PayPal has a cool opportunity to create your own personal page for receiving payments. Thus, by sharing a link to this page, you make life easier for other participants in the system, since they just need to follow the link and make you a translation.

So, to create your page you need to go to the section "Send and Receive" and click on the icon “Create a link to the PayPal.Me page”.

When you come up with an address for the page, save it and you can go to the address, see how the page looks.

I got it like this:

If you want to specify the transfer amount, add the desired number to the link.

Https://www.paypal.me/zaicev/10

Since the page is created in the account currency, there is no need to specify rubles.

But, if they transfer money to you in another currency, this is not a problem either. You can select a currency directly on your page by clicking on the currency button.

As you can see, everything is fast and convenient. I already received payments for.

And now I propose to watch a video tutorial with examples to consolidate the material.

I have everything for today, if you have any questions, I will be glad to answer them in the comments. Good luck to everyone and see you in new articles.

Sincerely, Maxim Zaitsev.

The development of online trading implies the availability of fast and secure payment methods that would allow you not to transfer money through a bank with filling out receipts and make purchases at a convenient time, being anywhere in the world. This led to the appearance on the market of payment electronic systems that offer users a different list of services and provide the ability to conveniently and safely process payments and transfer funds to their own accounts or accounts of other users. Such systems are the best way to entrust trade, both for individuals and business representatives.

A little bit about the history of the creation of the electronic payment system PayPal

PayPal Inc. was established in 1998, immediately occupying a niche in the service of electronic auctions. By the end of 2000, more than 1 million auctions working on eBay offered their customers to pay for orders through PayPal. At the moment, in most American and Western European chain stores, PayPal is a leader in processing payments and is confidently crowding out competitors. PayPal is an intermediary guarantor for online shopping. The system provides its services in more than 190 countries, uses about 30 types of currencies and has about 200 million registered users. Since 2011 PayPal has been operating in Russia and Ukraine.

Benefits of PayPal

- Globalness - the ability to pay for purchases anywhere in the Russian Federation and abroad in a matter of seconds.

- Ease of use - to complete the operation, you do not need to enter long details of banks and payment cards, just enter the user ID.

- High degree of transaction security and user data protection. The level of transactions classified as fraud in PayPal is much lower than with bank transfers and payment card transactions. In case of disputes between the buyer and the seller, if the buyer is right, he is guaranteed a full refund.

- Possibility of automatic exchange of currencies if the sender's account has a currency different from the recipient's account. Conversion can be performed both inside the system and through a bank specified by the sender.

- All payments in PayPal are made with "live" money, unlike other similar electronic payment systems. By linking a bank account or payment card to your account, you can carry out financial transactions, top up your balance or withdraw money.

- Opening and maintaining an account is free of charge, and for current operations a fee is charged from the recipient of funds. The amount of commission depends on the type of account, country of residence and card service bank.

How to use PayPal

For users from different countries PayPal - a separate set of services. The maximum list is available to residents of the United States and Western Europe, China, Australia. For residents of Russia, after creating their own account, the function of sending payments, linking a payment card to a PayPal account, withdrawing funds to bank accounts in rubles and transferring to the WebMoney system is available.

Registration takes place on the system’s website, the country of the user's location and the language of the website’s page are usually determined automatically. First you need to register in the system:

- Select “Personal account” or “Corporate account”, depending on the type of your activity.

- Enter the country of location, e-mail, create an account access password.

- Provide information about yourself.

PayPal is the largest payment system in the world with more than 179 million active users.

Since October 2012, it has been fully operational in Russia. With it, you can pay for purchases in online stores of any country, as it operates with 25 types of international currencies. “Payment buddy” (the name of the service is literally translated) allows you to make any financial transactions quickly and most safely.

In order to transfer money to friends or pay for goods and services, you need to register. To do this, go to the official website of the service and click on the special button (it is located in the upper right corner). After that, it will automatically go to the page for selecting the type of account: corporate or personal.

A personal account allows you to do the following:

- transfer funds to your relatives and friends;

- link a bank card to pay for online purchases;

- put money on your account to pay for goods and services, transfer to friends;

- withdraw money to a card or a ruble bank deposit.

When registering, you will need to indicate your email, create a password and fill out a form. Data entry is carried out in Russian. Filling in the required fields (name, passport data, address of residence, phone number, etc.), you must confirm the fact of familiarization with the user agreement, and then click the “Agree and create” button.

You can register, open and replenish your account for free. With future use, you can always change its status from personal to corporate. Creating a wallet, regardless of type, is possible only in state currency. But in the course of using the system, you can add other types of currency.

At the end of registration, you can attach a credit card to an electronic wallet, indicating only the bank card number, its expiration date and CVV2 / CVC2 code (the last three digits on the back of the “plastic”). After linking, you can replenish the wallet directly from the card or, conversely, withdraw money from it and transfer it to a credit card. You can also top up your account in cash through the stores of Svyaznoy and Euroset.

How to start using PayPal?

The first action that must be performed in order to start using the payment service is to confirm the email address. Only then will the account be considered created, and the user will be able to send and receive money transfers, including without a credit card. To do this, you must log in by clicking the link in the upper right corner of the screen. On the page that opens, you will find a link to confirm your email. After clicking on it, the system will automatically send a letter to the address specified during registration.

To complete the verification process, you must re-enter the password used to create the account. After that, instead of a link to confirm email, a green circle will appear with a checkmark inside. Now you can go to full use.

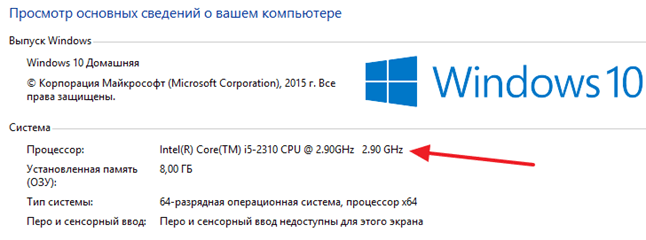

But before you start using the service, you should find out the available limits. They are set for all types of accounts. So, for owners of accounts with unconfirmed data, the monthly limit is 200 thousand rubles. The amount includes any financial transactions, whether it is withdrawal or crediting of money, payment for purchases online. One-time operations should not exceed a total amount of 60 thousand rubles. This means that without confirmed data, you cannot buy in the Macbook Pro 15 ’’ online store worth more than 150 thousand rubles or receive a transfer for a similar amount.

To increase the amount of financial transactions, it is necessary to confirm personal data. To do this, you must perform the following actions:

- enter the service;

- click on the link “Check your account limits” at the bottom of the page;

- on the page that opens, click the "Increase Limits" button.

Several confirmation options will be offered. To remove account restrictions, you must complete all of them.

One way to confirm passport data is to send a scanned copy of it (pages 2, 3, and 5). To confirm the card data, you must perform the following actions:

- enter accurate data (number, expiration date, security code);

- click the "Add Card" button.

Then, in the data confirmation window, opposite the line “Confirm bank card”, click the “Start” button. $ 1.95 will be deducted from the account. Let's consider further actions on the example of a Sberbank card. After debiting funds, you need to visit Sberbank-online, click on the “Bank Statement” link and find the required operation.

Next to the operation, you will see a verification code (4 digits) of the 2016CODE type. Log in to your payment system account and enter it in the appropriate line. At the end of the check, the blocked funds will be returned to the account automatically. If necessary, the card information can be deleted or changed.

Where and how can I pay for purchases?

Today, you can pay for purchases in tens of thousands of online stores around the world, including eBay, Ozon, etc. Many payment system partners provide account holders with special discounts; numerous promotions are held for PayPal users. You can find out about current offers by visiting the “Shopping Center” on the system’s website.

This section provides a complete list of merchants accepting payment through PayPal. However, there are a number of stores that are not ready to accept funds in this way. It is not possible to make purchases using this service on Aliexpress and Amazon. But this is understandable, because PayPal and the direct competitor of these trading platforms - the eBay company - previously belonged to the same group of companies. But, since the end of 2014, eBay Corporation has decided to separate PayPal into an independent structure.

Paying for purchases through the system is extremely simple. There are a few simple steps to take:

- visit the desired online store;

- add your favorite products to the cart;

- go to the checkout by clicking a special button or choosing from the list of available payment options.

After choosing payment via PayPal, a window will automatically open for entering the email address to which the wallet has been registered and the password for it. If before the time of payment you did not have your own account, you can create it right in the checkout process.

After entering the necessary data, a direct payment page will appear. At the same time, a credit card does not have to be attached to your account. You can specify its details at the stage of order confirmation.

The further procedure for placing an order is standard: you will need to specify the address, delivery method and other necessary information. Payment for purchases for visitors to Russian online stores is always free. But when paying for goods abroad, the system can deduct a conversion fee equal to 4% in excess of the wholesale currency exchange rate (if the seller refuses to pay it).

Holders of foreign currency debit and credit cards should first disable the conversion. Otherwise, the system will send a request to transfer funds in national currency (even if the invoice is issued in dollars or euros), and the bank will transfer the required amount at the domestic rate.

Secure payment with PayPal

An important advantage of using this payment service is the availability of a Buyer Protection Program. You can contact Support for a variety of reasons:

- non-compliance of the goods with the declared description;

- the presence of defects, damage, traces of wear of the goods;

- non-delivery of goods to the buyer;

- mismatch of size, style, color, etc.

In all of these situations, the Support Service will help return the funds to the buyer's account and reimburse the cost of shipping and return shipping of unsuitable products. The Program partially extends even to the acquisition of electronic tickets and documents.

To initiate the refund process, a number of actions should be performed:

- open a dispute after 7 or more days from the date of purchase by contacting the Problem Resolution Center;

- contact the seller for a peaceful settlement;

- close the dispute by mutual agreement;

- translate an open dispute into a claim if the seller does not respond satisfactorily.

It is noteworthy that the Center operates around the clock. Its employees will consider the application and make a decision, after which the money for the goods can be transferred to the buyer's account. Another advantage of using the service is the secrecy of personal data (account details or a credit card). To confirm the payment, you only need an email address and a password to enter.

How to transfer funds from the account?

You can create a PayPal account to make safe and fast money transfers. To transfer funds to friends and relatives, you need to make a couple of clicks. Just log in to your account and click "Pay or send funds" at the top of the screen.

After clicking, a window will open with two more links, one of which is for moving to sending funds from the account.

You can send a money transfer to absolutely any recipient in Russia who has their own email address. At the same time, it is not necessary for the recipient to have their own account. He will be able to register it after receiving a message about the transfer of money in his name.

You can transfer money not only from the account, but also from the linked cards. But in this case, the service charges a fee equal to 3.4% of the amount + 10 rubles. When transferring funds in non-state currency (US dollars, euros), an additional commission is charged on the conditions described above.

How and where to cash funds?

In order to cash out the balance on your account, you need to enter your personal account and click on the link “Withdraw funds”. If you have not linked a bank account to your account, you will be prompted to do so and go through the verification process. Two small amounts will be sent to the indicated account (crediting takes place within 3 to 7 days). You will need to know their size and indicate in the special fields when you click the link to the output again. At the end of the check, you can freely withdraw money to a bank account, without forgetting about the established limits. The withdrawal of money to a bank account or a tied credit card takes about 3 to 5 days.

There are other output methods:

- on a Qiwi wallet;

- on Yandex.Money;

- on Webmoney.

You can use them through one of the online exchangers - sites offering money transfer services between two services (for example, PayPal and Qiwi) for a certain fee. Its size sometimes reaches 10 - 12%, so before using it is important to find out the working conditions of the exchange office.

Withdrawals are available not only in our country, but also in Belarus and Kazakhstan. Residents of CIS countries such as Ukraine, Armenia, etc., also have to link the card and bank account to their account, go through the same verification procedure and receive their money directly to the MasterCard or Visa card. In this case, you can receive funds using a bank terminal (ATM).