To competently and simply conduct family accounting, there is a program for the family budget, which is called "Home Accounting". This software allows you to manage general and personal finances from various devices with data synchronization and exchange between a computer and mobile devices, since its versions work on Android, iPhone, and iPad. In the free test mode, it can be used for 30 days, after which it will be offered to buy software. However, for those who do not want to spend money, there are other services in the public domain that structure home expenses and income. The best programs for accounting and maintaining the family budget, which can be downloaded for free, are presented in our review.

Home Accounting Program

Since the offer from "Home Accounting" (http://www.keepsoft.ru/) can be used for a month for free, users who choose intuitive, simple and functional versions of software can, in this example, compare the capabilities of paid and free programs "in the field conditions. " Thanks to the function of uploading data to Excel in a month, you can return to the tables without loss of accounting if you wish.

The distinctive advantages of Home Accounting include:

- Accessibility of using not just a list of income for each of the partners, but a link to the “general wallet" of the status of several accounts - cash, bank cards, electronic money.

- An interface in which you can see the general picture in one table, and each of the subsections in a separately displayed window (for example, a loan and debt window).

- The ability to build visual charts that, at a glance, allow you to evaluate the current financial situation in the family.

- Additional features:

- revenue and spending planning,

- importing bank statement data,

- export to Excel, Word, Access, HTML

Unlike many free “empty templates”, the basic part is already registered here. For example, the items of possible expenses are introduced in such detail that it is extremely rare to add something (although there is such a possibility, as well as the opposite - the removal of the "extra" article). So 16 main basic categories of expenses are divided into many subcategories. For comparison:

- in the category “Car” 9 subcategories of “default” are already entered: Car wash, Gasoline, Spare parts, Tax, Repair, Parking, Insurance, Inspection, Fine.

- in the category “Clothing” - 44 subcategories.

- in "Household goods" - 62 options from nails and hangers to light bulbs and filters.

Thanks to such detail and even the “meticulousness” of the authors, it’s much easier to plan, as the menu itself seems to suggest something that is usually forgotten in everyday chores.

Separately, it should be noted the search function with details on names, categories, subcategories, repaid and outstanding debts, notes, etc. That is, by entering a marker word in a note, you can use search to immediately see all movements that relate to an “encrypted” topic .

The mobile version of the service differs from the offers of most competitors in its functional variety, which becomes noticeable even when you look at the start menu.

The mobile version of the service differs from the offers of most competitors in its functional variety, which becomes noticeable even when you look at the start menu.

The “Home Bookkeeping” has many good reviews from users with many years of experience who note its dignity, and one “drawback” is that it is paid. Software allows you to log in, changing user names, and conduct independent budgeting. However, in a paid offer, this advantage is leveled, because for the free use of several family members, most likely, you will need to buy a more expensive license.

In total, there are 3 main options and a monthly subscription with renewal:

- Private license for installation on one computer - 800 rubles. during the discount period and 990 rubles on an ongoing basis.

- Family license for two computers 1200 rub. at a discount and 1490 rubles. - without.

- The same cost is the portable (recommended by the manufacturer) option for free movement of the program on a USB flash drive.

“Family budget”: program, reviews, opportunities

“Family budget” is a program for Android, the free version of which can be considered as a good example of bringing a useful product to the market for free. Of the minuses of use are called only:

- the presence of advertising that is disabled for money,

- the ability to backup only to the memory card of a mobile device in version 2.1.11, while you can download the family budget program for free and without registration in version 2.2.5–2.2.7 (for example, here http://top-android.org/programs / 1379-semeynyiy-budjet /) - general requirement: Android from 2.1 and higher.

“Family Budget” is an official mobile application for Android that duplicates the functionality of a web service for accounting.

The advantage over desktop-top competitors is that in a mobile application all expenses can be entered “without leaving the cash desk” and without forgetting about them.

And there are a lot of such everyday petty waste, and it is they that require special consideration, because, judging by the statistics, the general treasury quietly melts not when buying TVs and refrigerators, but because of snacks, coffee breaks and unaccounted beer on Fridays.

To create a new record in the accounting history:

- select a menu item

- enter the amount of expenses and a note,

- mark a category (either create it yourself or select from a ready-made list).

The functionality added in later releases allows you to specify the means of payment, fixing the status of funds on a bank card and cash in your wallet. Synchronization with Mobile Bank is available. A separate section is reserved for planning potential costs.

- At the beginning of the month, the total amount of upcoming expenses is calculated and indicated.

- The amount is signed in categories indicating the portion planned for food, utilities, loan repayments, etc.

- The end of the month shows savings or negative balances.

As in the previous software, this application provides a search, the ability to leave notes, as well as generate a report on movements in the family wallet in the form of diagrams.

AndroMoney, CoinKeeper, Expense Manager Andromoney

It looks like the previous and another multi-functional AndroMoney application, which is also used to record housekeeping on Android devices. The aim of the developers was to make the interface for the hostesses - an intuitive menu without compromising functionality.

There is a free version and a Pro version (about $ 5). The advantages include: choosing the “step” (day, month or year), narrow budgeting for certain categories and the ability to create copies both in the device’s memory and in cloud storage services (Google Drive, Dropbox). Data can be password protected and, if necessary, converted to CVS format for working on a PC.

Coinkeeper

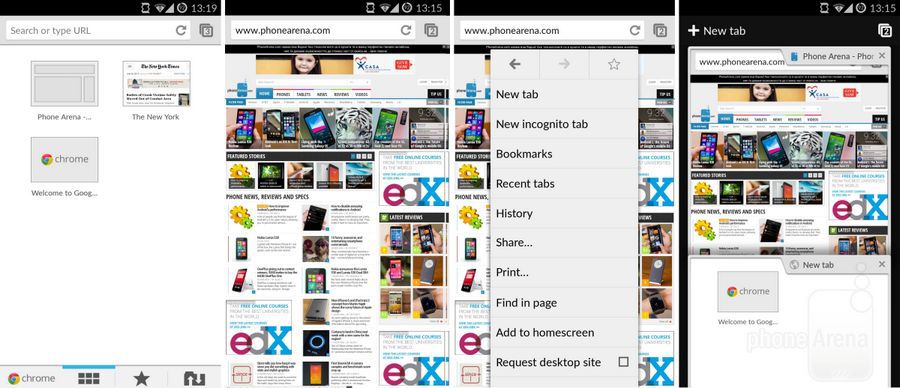

The difference between shareware (the first half of the month a test version is used) of the CoinKeeper platform from others is that it allows both “manual control” of your finances and automatic mode, for which you must first specify a monthly income. The work will be facilitated by the fact that each menu item is explained, thanks to which the platform has one of the most understandable interfaces among similar products.

Allowed: synchronization with other devices, storage in cloud services, setting a password. But, in comparison with others, this application has few reports, there is no "desktop" version, slow animation.

Expense Manager (from Bishinews)

In Expense Manager (from Bishinews), in addition to the limited functionality of the free option (the full version also costs about $ 5), the absence of the Russian language is considered a relative disadvantage. In an English-language environment, multimillion-dollar downloads demonstrate the popularity of this software. Here you can plan the ratio of income to expenses, change the settings for yourself, display a detailed schedule of expenses, store information in the cloud or on a memory card. The interface looks minimalistic, but it only simplifies the work of both the user and the gadget.

In order to protect yourself from big expenses and save up for a small house in a European province, it is not necessary to deny yourself everything and tightly sew up your savings in socks. By installing EasyCost, you can achieve more: for example, save up for a one-room apartment. To do this, just indicate the amount of your income and mark expenses every day. All costs can be divided into several cards: work, family, travel and so on. This application is not without its drawbacks and has an extremely high entry threshold for beginners, but if you manage to figure it out, you will get a convenient financial planner.

For use, registration and Internet access are not required.

It is possible to select icons for manually created expense categories.

Overloaded, not friendly to beginners and absolutely unobvious functionality with a bunch of obscure buttons.

Acquaintance with new functions happens quite by accident, as a result of pixel hunting on the screen. Most of the application options for us have remained a mystery.

Absolutely unobvious button with entering funds into the budget, hidden in the general list of expenses - look for a plastic card with the signature “Salary”.

m8 - my money. My way

The main feature of this application is the visualization of expenses in the form of two columns. Having indicated your quarterly income and daily marked expenses, in the right column you will see the scale of costs, and in the left - the cash balance. The second feature of the application, which developers are proud of: upon reaching a certain threshold of your cash reserves, the smiley, soaring serenely at the top, will gradually begin to feel sad until it finally frowns - this will be a signal that it is time to get out of the couch and go make some more money.

A good visualization of expenses that visually displays the state of affairs in your wallet.

By clicking on the emoticon, you can see how your financial affairs are: very good, good, good or bad - the developers call this the current status.

If desired, you can change the emotions of the emoticon and the names of the stages. For example, a smiley will smile, even despite your bankruptcy.

After adding a new expense line, it automatically joins the tag cloud that pops up with each set. If desired, they can be deleted in the settings.

Costs can be scored for the future and after the fact.

The types of your income and expenses are not displayed on the general diagram - to access them you need to make one extra movement.

Money care

An application for meticulous bookkeepers and simply big money lovers, ready, like Scrooge McDuck, to recount their income every free minute. If you are not afraid to sacrifice your time and amenities for the sake of accuracy of cost accounting, then this application will definitely take its rightful place in your phone. For all its ugliness and external hostility, Money Care has a rich functionality that allows you to take into account a bunch of different little things: look at schedules of your expenses, divide expenses by several people, and so on.

To ensure that your records are not lost, the application provides the ability to send a backup copy of the file to mail, Dropbox or Google Drive.

For beginners, a hint system is provided. But even to deal with it the first time here is not so simple.

All transactions can be divided into several accounts. This feature is especially useful for families with a common budget.

You always have three indicators at hand: revenue, costs and balance.

All information about your income and expenses can be exported to Excel and sent by mail.

You will be allowed to make no more than 50 entries for free, and you will have to pay 99 rubles for the unlimited version.

The process of adding revenues and expenses is too complicated and long: enter the name of the transaction - confirm, add the amount - confirm, do not forget to assign the category - confirm, and then confirm the whole operation again.

Very small menu items - to get to the right buttons, you need to have very thin fingers.

Daily budget

An ideal app for consumers with daily shopping syndrome, that is, for all of us. If you want to start saving money for something more substantial than lunch in the dining room, this application will help you pull yourself together and calculate the amount of your daily expenses. To start the cost containment operation, you need to drive in your monthly income, indicate the amount of standard monthly expenses (for example, utility bills) and indicate the percentage of the total income that you want to save in the piggy bank. After a little thought, the application will give you the amount that you can safely spend during the day.

So that you can’t circle yourself around the finger, the application provides reminders for incurring expenses.

For each expense, you can add a comment justifying your extravagance.

Moni

The most unpleasant feature of incomes is that they quickly turn into expenses, threatening to leave you without money at the most inopportune moment. To prevent this from happening so quickly, you can swear only to earn money without buying anything, or you can just keep track of your expenses. Thanks to Moni, your cash will always be in your sight, for this you just need to carefully note every purchase.

If you live among thieves and hypocrites, then the application can be protected with a PIN code. Four identical numbers are not prudently accepted.

For beginners, there are tips.

For various types of expenses beautiful icons, colors or other types of visualization are not provided.

Sometimes you just don’t understand: where they are leaving, where the money is coming from. And to deal with this problem is sometimes not easy. Moreover, many have loans and do not want to constantly think about them so as not to miss the deadline for paying the next installment.

There are two main solutions:

- Use Microsoft Excel and write expenses and income there. In theory, a very simple and convenient option. But in practice it’s not very convenient, especially when you need to make some kind of report, for example, monthly expenses for housing throughout the year. Everything has to be done manually. However, for greater clarity, I use this method. Although, if I change the program for home accounting, then you can not use this option.

- Use a special online service. Great option. You can go to your accounting from any device: computer or smartphone. There are such disadvantages, such services have problems with data protection, and there is always a risk that someone will hack your account and find out everything about your financial condition. Yes, you need a permanent internet connection. And it costs money, especially for mobile devices: smartphones and tablets.

- Use for these purposes a special program for home accounting. At the moment, the most ideal option. It is very easy to create reports, and there are no problems with data protection.

And now we will consider in detail the last option. And similar software is divided into two large groups:

- for home user. Everything is optimized there for keeping a home budget. Most often, such software is free and it basically has the following functions: accounting of expenses and income, work with debts. In principle, nothing more is needed for the home budget. I myself use a similar program. And everything suits me. Among them, there are also paid ones that support working with online banking, but here the security question already arises. I myself do not really trust such programs. Although even if they hack you, they will not be able to transfer money from your account. For this, such programs as DomFin, Home Bookkeeping, AceMoney Lite, MyMoney, Family Bookkeeping and Zhadyuga are best suited.

- for running a family business. There is already a large set of various reports, and work with a large number of different accounts. But again, such software is far from professional accounting. But for running a small business under a simplified taxation scheme, it’s enough. Similar programs also have various additional features: debt reminders, exchange rates, and so on. Such software for accounting is mostly paid, but there are also options for free with a maximum income for the month. This is such software as MoneyTracker and CashFly.

|

Paid and free home accounting software (just click on its name to go to the analysis and then download it): It is valued for its simplicity and free; for convenience.

It is appreciated for its excellent functionality; for being simple, comfortable and without unnecessary troubles. She is valued for being free and easy to use. |

There are many obstacles to controlling the family budget - laziness, lack of time, insecurity, lack of knowledge and experience. Accounting for costs in the long run is beneficial, because statistics clearly demonstrate all the excesses. Daily insignificant financial losses turn into big expenses if you look at them from the “height” of a long period of time. People live in the present and very few are able to calculate their family budget for the year ahead.

To facilitate financial planning, it is recommended to use special software. There is a whole class of programs that are designed to maintain a family budget. Such a program is enough to take into account expenses, plan future costs, control loans and other aspects of the financial life of the family. If you want to know how much you spend on food, cars and entertainment, then you can not do without special software. If you have at hand a program for recording income and expenses, then over time you will find in your budget all the weaknesses. And do not just discover, but you can eliminate these "black holes", while receiving significant savings in money.

This review was created to help you choose a program for maintaining your family budget. We tested the most popular windows-programs designed for financial control. The main focus of the review is the accounting of expenses and income exactly at the family scale, that is, programs must be multi-user so that the expenses of each family member can be taken into account in one application.

Poll: Have you previously controlled the family budget?

Family budget "Housekeeper"

The installation file size of the program is less than 3 Mb - this is the most compact program of all considered in this review.

After installation, it turned out that there is a demo base that helps the user understand the principles of the application. In the "users" section, you can find a list of users (family members) and account structure.

Adding a consumable operation is carried out in the "expenses" section - click the "add" button, indicate the categories of expense, account and amount. And then we press the button "choice". A new entry in the table "expenses" is added. Please note that in the process of adding a transaction (expense or income), you must specify an account to write off (or credit) money. For clarity, in the tables of expenses and incomes, the categories are highlighted - each of them has its own color. You can customize the colors in the "reference" section.

The main principle of the Family Budget program is that each family member has his own accounts and any transaction is tied to a specific account. This approach allows you to maintain a family budget for each user separately, and for all together.

The appearance of the program leaves a good impression - the interface is thought out, the control buttons are conveniently located, there is the ability to sort data. For example, you can view expenditure transactions only for a specific month and for a specific user. For this, elements such as "user", "month" and "year" are used. Above the table there is a mini-report that shows the total amount in the table for the month (taking into account the “user” filter).

The income section works in a similar way. To add a profitable operation, click the "add" button, select a category (for example, "salary"), indicate the account to be credited and enter the amount. At the top of the window, you can select the user to whom the transaction will correspond. When a user is selected, all of his accounts are automatically loaded, and we have the opportunity to indicate to which account the money will be credited.

If you are fully comfortable with the Family Accountancy program, you can delete the demo database. To do this, delete all users in the "Users" section. Moreover, all data in the income and expense tables will also be deleted. Then you should add real users, set up their accounts and start maintaining a family budget.

As the base currency, you can use any currency of the world (rubles, dollars, euros, yens and others). Each user can have any number of accounts in any currencies. When building reports, the program will automatically recalculate all currency transactions into units of the base currency. For this purpose, each account indicates the exchange rate in relation to the base currency (section "users" - "accounts").

Now consider the “reports” section. To build a report on expenses for the month, select the appropriate type of report and click the "build" button. We get the data in graphical form. The chart displays the categories of expenses and the amounts that correspond to them. By clicking the right mouse button on the chart, you can configure it: show amounts or percentages, show a legend, sort, etc. Opposite the “report type” area, there is a button for selecting a report in a visual form. If you click it, a window will appear where reports are grouped into categories - expenses, income, debts and users.

The reporting system in the Family Accountancy program is very simple and straightforward. Even novice users can easily deal with reports. The built-in help system will help you quickly master the program - in almost all sections there is a button with a picture of a question mark. By clicking on this button, you will receive help on the desired section.

Another program is able to work with debts and loans. If you gave a loan, the application will automatically remind you if the debt is not returned on time. The “loans” section is responsible for your debts - here you can add any type of loan (mortgage, car loan).

Conclusion. Family bookkeeping “Housekeeper” is a simple and effective tool for maintaining the family budget. It has everything you need: accounting for expenses and income, support for currency accounts, multi-user mode, convenient and visual reports, work with loans and debts, monthly reminders. The program is very simple, and the interface is so thought out that a help section may not be needed. The speed of reporting and data entry is high. Program price: from 0 to 300 rubles (it is possible to use for free). If you are just starting to control your family budget, we recommend starting with this program.

Alzex Personal Finance

When the Personal Finance program is launched for the first time, the user is prompted to make basic settings: specify the language, date format, numeric separator, select a folder for the backup. It is noteworthy that the program interface is translated into many languages \u200b\u200b- the list contains at least 20 languages. At the beginning of work with the application, the user has the opportunity to download a demo database.

The first section of the program is called "overview". All financial transactions are displayed here. The most important information on the list is the amount, date, category and family member. Any entry can be changed - for this you need to double-click on the line.

Another interesting feature of this section is the presence of unconfirmed transactions. This is convenient if you use auto payments. For example, you pay monthly subscription fees for the Internet. The program can be configured in such a way that every month it adds an expense transaction to the list of transactions. The status of the operation will be as follows: “awaiting confirmation”. You immediately see both a payment reminder and an expense transaction.

To add a new transaction, press the “Insert” key or the right mouse button and select “add transaction”. In the new window we indicate the type of operation (income, expense, transfer), category, family member, account and amount.

In the “transactions” section, the structure of expenses on user accounts is presented in a visual form. By clicking on any account in the list, you can get the structure of expenses and income. It is a pity that the program does not link accounts to family members - it turns out that the account is primary and the user is attached to the transaction, and not to the account. For example, Anya can pay from Sasha’s account and vice versa. Keeping a family account in this program is possible only by considering all the money and accounts as common.

The program has a cost and income planner. In the "scheduler" section, you can add the desired operation to the plan. It is also easy to adjust the frequency of a new operation - perform daily, weekly or monthly. The “budget” section is responsible for planning the family budget - here you can set limits for the categories of expenses. The Debts section controls your debts and debtors.

The section “reports” is responsible for the construction of graphs and diagrams. To see the structure of expenses for the month in the form of a diagram, you need to select "view - overview - expenses" and "schedule - circular". If you are interested in any particular time interval, then you should click on the month and set the "arbitrary interval". In order for the chart to display amounts, not percentages, you need to click the “chart” and check the box “show values”. In our opinion, the reporting system in the program is not ideal. For example, we could not build a report on the expenses of a particular user.

Conclusion. The appearance of the program leaves a good impression. There is a good event planner and the ability to plan a budget. But the application has a rather confused way of displaying transactions - it is easy to get lost in a single list. It is also embarrassing that you can add an expense without reference to a specific family member (how then should these data be taken into account?). Accounts are not tied to users - an arbitrary name is indicated in the account settings. In the demo version of the program there is no way to build a report on the expenses of each family member, and this is an important report for the family budget. It will be difficult for an inexperienced user to immediately understand the reporting system. Price Personal Finance - 590 rubles (personal license), for a commercial license will have to pay 990 rubles.

If you and your family members thought it was convenient home accountingTo visually see not only your income, but also your monthly expenses, the familiar paper notebook with a pen is an outdated option, and standard Excel is, of course, not bad, but if you have not fully mastered this program, then a special program for conducting home bookkeeping, which is quite easy to download for free on the Internet, will be the best solution for realizing your goals.

There are a lot of such programs, so among all the variety you will definitely find the one that turns out to be ideal for you. Programs for accounting for the home budget can be either paid or shareware ( limited functionality or with a trial period) and completely free. I would like to immediately note that free programs do not mean " bad»Program, because they also have all the necessary functionality for competent and clear accounting of family funds. The differences most often lie in the design, as well as in some convenient “ chips", Without which, in principle, you can do.

In our article, we will examine in more detail completely free programs, as well as those that you can download for free, but in the future they will need their activation to expand the functionality. All programs in our review are issued in Russian.

Free Home Accounting Software

Cubux

Cubux(www.cubux.net) is a fairly convenient service for managing income, expenses and debts online. Using a gadget or just a computer, data is synchronized and stored from all devices in one database.

Maintaining a common budget with the whole family is quite possible with the help of the “Joint Accounting” function. After leaving the store, you can quickly and simply create an operation for the expense, thanks to the function "Multi-flow". The action is performed in three clicks: Account, Category, Date and after entering the amount, the expense is saved.

The report on your finances is monthly reflected in statistics. Do not forget about your debts, as well as about your debtors, the "Debts" section will help.

Use the instructions for using the service or contact the technical support service to resolve the issue. Do not worry about the data, you can download it to an Excel file and save it to your computer.

Supported platforms: Windows, IOS, Mac Os, Android.

(http://homebank.free.fr/) - fully freean application that allows you to organize - accounting of expenses and income. A distinctive feature of this program is that it supports data exchange with the service Microsoft money, and Quickenand some other applications. Works using the following formats:

(http://homebank.free.fr/) - fully freean application that allows you to organize - accounting of expenses and income. A distinctive feature of this program is that it supports data exchange with the service Microsoft money, and Quickenand some other applications. Works using the following formats:

- QFX (OFX);

Features of work:

- the possibility of splitting expenses and income into categories;

- data output in the form of diagrams;

- planning for future expenses;

- the ability to create transactions in automatic mode;

- visualization of current operations;

- import data in certain formats that the program works with.

If you decide to download for free (https://dervish.ru/), then opening the program for the first time, its interface may seem too simple, straightforward and not attracting attention, but do not rush to close the newly installed application. If you stay in it for at least 20-30 minutes, you will understand that it is unique and completely in front of you free without registration a lot of opportunities open up.

With AbilityCash you can:

- create a variety of accounts without limiting their quantity and currency;

- work with popular formats. xls and.xml;

- print various report options on paper;

- use some rare languages \u200b\u200b(Ukrainian and Lithuanian);

- customize the appearance to your preferences: add options hidden by default (“price”, “quantity”), use a tree structure with the ability to add an unlimited number of subcategories, make notes and important marks to specific cells.

By default, only the Russian ruble is preinstalled, but the list of currencies can be expanded using current data from the site of the Central Bank of the Russian Federation.

Another fully released program in Russian language (http://www.softportal.com/software-4910-semejnij-byudzshet.html).

Among the benefits Family budget the following can be noted:

- can keep track of income and expenses on several accounts at once;

- the function of automatic selection of categories is available, i.e. starting to enter a specific product, it will automatically be sorted into a specific category;

- the ability to create a report of 8 points by pressing just one button;

- use of the popular formats .bmp, .txt, .xls, .doc;

- printout of reports;

- the ability to use the program at once by several people, and registration is free for each user with the creation of their own username and password, which must be entered at the entrance.

(http://myhomesoft.ru/) in addition to the standard features for accounting for income and expenses, family budget planning, it has some individual features that distinguish the program from analogues:

- the ability to create multiple accounts.

- not only cost analysis is available, but also their control, i.e. upon reaching a certain maximum set by you, the program will notify you of approaching the mark;

- the ability to account for debt obligations, both yours and those who owe you;

- use of various currencies;

- creating backup copies of the database, which can subsequently be restored or uploaded to Microsoft Excel.

(http://www.domeconom.ru/) refers to free programs without registration for home accounting, so it can be downloaded from both the official and any other site.

The program allows you to work on multiple devices at once, and through automatic synchronization.

The functions of this utility otherwise completely repeat the similar and standard for similar programs ( e.g. Home Bookkeeping, and other free software).

What is noteworthy, the help is implemented quite competently and clearly, therefore, if you don’t know where to start or how to organize work with the utility, then after reading the appropriate section, you can easily figure out the problem.

(http://www.ownmoney.org/) - a completely free application with great features:

- accounting of income, expenses, including those that you plan in the future;

- multicurrency, unlimited number of accounts and accounts;

- tree structure with various subitems and branches;

- transfer of funds between accounts;

- automatic updating of exchange rates;

- accounting not only for purchases, but also for their weight;

- the ability to schedule some operations in automatic mode, as well as temporarily disable such payment;

- work with counters, as well as accounting for benefits and discounts.

(http://www.softportal.com/software-1128-cashfly.html) - free home accounting, which allows you to calculate complex operations associated with income and expenses for various items. Among the main advantages are:

- the ability to archive data;

- password protection;

- drawing up planned operations;

- building graphs and charts for various parameters;

- the ability to print data;

- address book for recording data of persons and organizations;

- the ability to keep a diary and set up alerts for memorable dates.

Shareware for home accounting

These programs can be downloaded free of charge without registration, but to expand the functionality or long-term use may require payment.

(http://www.mechcad.net) is available in four versions, so you can download the full version or use the Lite version, as well as use add-ons. The Lite version differs only in that with the help of the program you can manage no more than two accounts, but for most families this will be more than enough. An account here means not only bank cards or accounts, but also the cash of family members, i.e. if the family has two employees, then the Lite version will be enough for them. The cost of the full version of the program is 1 300 rubles.

Using AceMoney, you can:

- manage your money in various currencies (more than 150 types of currencies are represented);

- monitor online changes in exchange rates;

- allocate your budget according to cost items (more than 100 options for spending money are predefined in the program);

- tracking budget revenues and expenses;

- calculation of expenses according to a specific sample for the time period of interest (utility bills, mobile communications, products, etc.);

- reporting (common formats are available. xls and .html);

- accounting for savings, debt, mortgages;

- the ability to create a backup, etc.

The program (https://www.keepsoft.ru/) is one of the most common among those that are distributed on the Internet for free. Today you can download the Home Bookkeeping program for free without registration from many services, but do not flatter yourself, since you will have to pay 400 rubles to get the full extended version. This computer application will allow not only to calculate the accounting of expenses and income in the family, but also cope with the bookkeeping in a small company.

Home Accounting Program May:

- keep track of expenses and income;

- calculation of debt obligations (both yours and those that formed before you);

- calculate the possibility of partial repayment of debts, as well as interest on debts;

- remind you of the time to pay debts or obligatory payments;

- build reports in the form of tables and diagrams;

- synchronize databases, compress them, clean up excess, etc.

Main advantages over other programs:

- availability of pop-up budget planning tips;

- updating via the Internet;

- customization of the interface;

- the ability to convert data in the 15 most popular formats;

- currency exchange, current information on 5 selected currencies, current rate;

- planning income and expenses for the future, etc.

You can download the Home Accounting program for free without registration on the official website (https://www.keepsoft.ru/), here you can expand the functionality.

Family pro

Family pro (http://www.sanuel.com/en/family/) - Another shareware version of the paid program. Do not rush to look for something else, since it is quite convenient to use and for free 30 days you can definitely understand whether it suits you specifically or if you should look for something else. If free version you are completely satisfied, then to give for a full package of 500 - 600 rubles is not so much.

For private business purposes, this program is also suitable for home accounting, which can be downloaded for free from many Internet services. In this utility, the most interesting and competent among competitors is the ability to create and save reports, as well as instant sending to print. Using Family Pro, you can create the following types of reporting:

- family budget analysis;

- detailed report on items of expenses and income;

- comparative analysis by months;

- analysis of debt obligations and a list of debtors;

- comparison of income and expenses, etc.

Using the utility tools, the user can plan deposits and loans for free, forecast spending and budget revenues for a specific month or period, predict a possible cash flow if there are several sources of income and an “in-mind” account is completely unacceptable.

(http://www.personalfinances.ru/) is unique in that you can create on your computer a specific database of your budget, you can download home accounting and on your mobile device by installing a similar application based on Android or IOS and synchronizing information.

The Personal Finances program is presented in a free demo version with limited, but sufficient for comfortable use, functionality, as well as in a paid version starting at 2,450 rubles (personal and commercial licenses). Moreover, these licenses are mutually exclusive, i.e. Commercial cannot be used for home and vice versa.

The program has a lot of opportunities:

- family budget management;

- tracking mode online interest on deposits;

- the ability to repay loans;

- multicurrency with the ability to update courses from the Internet;

- organization of expenses not only by categories, but also by each family member;

- work with debts;

- reports in the form of graphs, charts, projects, etc.

Economy

Program Economy(http://home-economy.ru/) is ideal for those who are not “friends” with economic and financial terminology at all, and who cannot distinguish the concept of “transaction” from “investment”. There are no hard-to-understand terms and words, so this utility can probably be used even by a teenager or an elderly person.

True, the program is not completely free, because there are limitations: if your budget is more than 14,000 rubles per month, buy the paid version.

Advantages of the application:

- simple, intuitive, convenient and nice looking interface;

- creation of an unlimited number of accounts and accounts in each of them;

- the ability to create foreign currency accounts, as well as accounting in various currencies;

- a reminder of the dates of payment of loans, utility bills and other obligatory payments;

- the possibility of using all kinds of filters;

- data backup, recovery option;

- reference information for Russian-speaking users.

If your budget has grown above 14,000 rubles, then you can always buy a paid version, especially since its cost is only 250 rubles.

Conducting personal accounting on the Internet

Home accounting can be conducted completely free even without downloading any applications to your mobile devices or home computer, as today there are quite a lot of online services for recording expenses and family income.

Among the most common and free are the following services:

- Rubbish;

- Where is my money?;

- Easy finance;

- Homemoneyetc.

The convenience of these services is that there is no need to download applications, and all data is stored on servers on the Internet, which allows you to view your entire history from any computer or device with Internet access. At the same time, functionality does not suffer at all, since you have access to all the same functions and features as standard programs.

Budget planning is the key to a successful life, even with a small income.

This article presents far from all currently existing home accounting programs and. Only the most popular, successful, and also available for download without restrictions are described here. If desired, each Internet user can find something more suitable for themselves than is presented here. For example, X-Cash, Xenon, Home Finances, DaReManager or something else. Look for what suits you and plan your budget!

If you find an error, please select a piece of text and press Ctrl + Enter, and we will fix it! Thank you so much for your help, it is very important for us and our readers!